WTI after consecutive drop of eight days, found support around $40/barrel, after militants' attack in Paris, heating up tensions in Middle East amid increased bombing by France in Syria.

Key factors at play in Crude market

- According to IEA it might take until 2020 for oil to reach $80/barrel.

- Due to new and improved technologies, crude oil production cost has declined for shale producers.

- OPEC report showed, crude production dropped to 10.1 million barrels/day in Saudi Arabia but overall OPEC production is still high at 31.4 million barrels/day.

- Middle tension rose with French joining bombing raids and increased possibility of grand coalition against Islamic state.

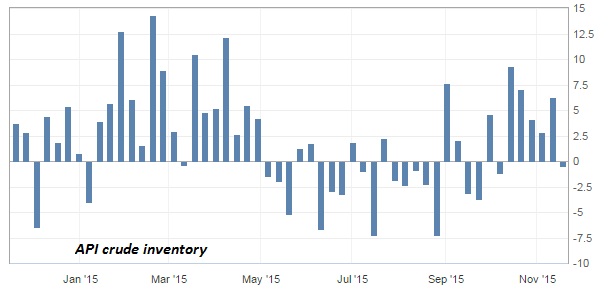

- American Petroleum Institute's (API) weekly report showed inventory decreased by -0.482 million barrels. Inventory decreased first time in six weeks.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Trade idea

- After eight days of consecutive drop, WTI formed an engulfing candle, suggesting price might correct higher if it clears above $42.2/barrel. WTI is currently trading at $41.1/barrel.

- WTI however likely to drop towards $35/barrel area.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary