Blockchain-based project Antshares explains why it chose the delegated Byzantine Fault Tolerance alternative (or dBFT) over Proof-of-Work (PoW) and Proof-of-Stake (PoS):

With the phenomenal success of Bitcoin and its increasing mainstream adoption, the project’s unbounded appetite for energy grew accordingly. Today, the average Bitcoin transaction costs as much energy as powering 3.67 average American homes, which amounts to about 3000 times more than a comparable Credit Card settlement.

This mind boggling amount of energy is not, as it is commonly believed, being wasted. It is put to good use: securing the Bitcoin network and rendering attacks on it infeasible. However, the cost of this security mechanism and its implications for an increasingly warming and resource hungry planet led almost the entire crypto industry to the understanding that an alternative has to be found, at least if we’re interested in seeing blockchain technology gaining overwhelming mainstream adoption.

From PoW to PoS

Proof-of-Work (PoW), Bitcoins consensus algorithm responsible for the networks high energy demand, renders the system’s bookkeeping mechanism artificially resource intensive. Bitcoin nodes, mining blocks and verifying transactions, have to proof the performance of cryptographic tasks in order to be eligible for the sought-after block reward.

As a result, anyone trying to forge BTC transactions, or otherwise compromise the blockchain records, would have to outcompete all other miners and the energy they’re investing in keeping bitcoin nice and clean. According to the energy estimates stated above, this means that thanks to PoW, an attacker would have to invest the aggregated energy consumption of a small North-American city, just to enforce their will on the Bitcoin blockchain.

The most popular alternative to PoW, used by most alternative cryptocurrency systems, is called Proof-of-Stake, or PoS. PoS is highly promising in the sense that it doesn’t require blockchain nodes to perform arduous, and otherwise useless, cryptographic tasks in order to render potential attacks costly and infeasible. Hence, this algorithm cuts the power requirements of PoS blockchains down to sane and manageable amounts, allowing them to be more scalable without guzzling up the planet's energy reserves.

As the name suggests, instead of requiring proof of cryptographic work, PoS requires blockchain nodes to proof stake in the currency itself. This means that in order for a blockchain node to be eligible for a verification reward, the node has to hold a certain amount of currency in the wallet associated with it. This way, in order to execute an attack, a malevolent node would have to acquire the majority of the existing coin supply, rendering attacks not only costly but also meaningless, since the attackers would primarily harm themselves.

Good, but not good enough

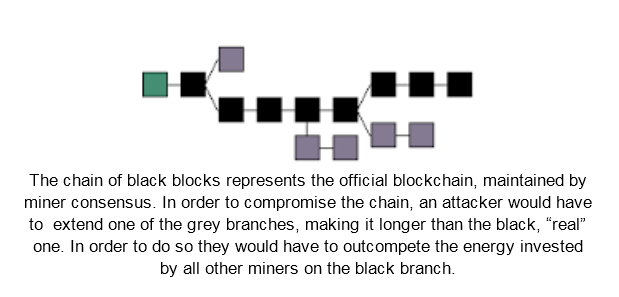

PoS is a viable alternative to PoW, which although highly energy inefficient, has proven itself as trustworthy during the last eight years. However, both systems have a crucial flaw, rarely addressed in the still somewhat countercultural crypto community. PoS, as well as PoW, simply cause the blockchain to fork into two alternative versions if for some reason consensus breaks. In fact, most blockchains fork most of the time, only to converge back to a single source of truth a short while afterwards, as it is depicted in the image above.

By many crypto enthusiasts, this obvious bug is very often regarded as a feature, allowing several versions of the truth to survive and compete for public adoption until a resolution is generated. This sounds nice in theory, but if we want to see blockchain technology seriously disrupt and/or augment the financial sector, this ever lurking possibility of the blockchain splitting into two alternative versions cannot be tolerated.

Furthermore, even the fastest PoS blockchains out there can accomodate a few hundred transactions per second, compare that to Visa’s 56,000 tx/s and the need for an alternative becomes clear as day.

Why the Antshares project chose dBFT over PoW and PoS

The goal of the Antshares project is to allow everyone to digitalize real-world financial assets, such as shares and securities. Such assets are highly regulated, since the smooth operation of entire markets and the global economy is dependent on them. Attacks on systems handling securities of this sort can’t be merely costly or technically infeasible, they ought to be as close to physically impossible as it is in our power to provide.

A blockchain securing global stock markets does not have the privilege to fork into two alternative versions and just sit and wait it out until the market (or what’s left of it) declares a winner. What belongs to whom should be engraved in an immutable record, functioning as a single source of truth with no glitches permitted.

After investigating and studying the crypto industry and blockchain technologies for several years, we came to the conclusion that the delegated Byzantine Fault Tolerance alternative (or dBFT) is best suited for such a system. It provides swift transaction verification times, de-incentivises most attack vectors and upholds a single blockchain version with no risk of forks or alternative blockchain records emerging - regardless of how much computing power, or coins an attacker possesses.

How does Antshares dBFT work?

The term Byzantine Fault Tolerance (BFT) derives its name from the Byzantine Generals problem in Game Theory and Computer Science, describing the problematic nature of achieving consensus in a distributed system with suboptimal communication between agents which do not necessarily trust each other.

The BFT algorithm arranges the relationship between blockchain nodes in such a way that the network becomes as good as resilient to the Byzantine Generals problem, and allows the system to remain consensus even if some nodes bare malicious intentions or simply malfunction.

To achieve this, Antshare’s version of the delegated BFT (or dBFT) algorithm acknowledges two kinds of players in the blockchain space: professional node operators, called bookkeeping nodes, who run nodes as a source of income, and users who are interested in accessing blockchain advantages. Theoretically, this differentiation does not exist in PoW and most PoS environments, practically, however, most Bitcoin users do not operate miners, which are mostly located in specialized venues run by professionals. At Antshares we understand the importance of this naturally occurring division of labor and use it to provide better security for our blockchain platform.

Accordingly, block verification is achieved through a consensus game held between specialized bookkeeping nodes, which are appointed by ordinary nodes through a form of delegated voting process. In every verification round one of the bookkeeping nodes is pseudo-randomly appointed to broadcast its version of the blockchain to the rest of the network. If ⅔ of the remaining nodes agree with this version, consensus is secured and the blockchain marches on. If less than ⅔ of the network agrees, a different node is appointed to broadcast its version of the truth to the rest of the system, and so forth until consensus is established.

In this way, successful system attacks are almost impossible to execute unless the overwhelming majority of the network is interested in committing financial suicide. Additionally, the system is fork proof, and at every given moment only one version of the truth exists. Without complicated cryptographic puzzles to solve, nodes operate much faster and are able to compete with centralized transaction methods.

For more information about Antshares technology, and how we intend to make blockchain powered, decentralized commerce a reality, read our whitepaper and visit us here.

Blockchain project Antshares explains reasons for choosing dBFT over PoW and PoS

Tuesday, April 25, 2017 6:38 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary