Today's Bank of England MPC meeting has left rate policy unchanged which was quite expected upfront.

Well, the data events for current calendar and market focus is on the US labour market report and the looming series of payments to the IMF by Greece this month, including around €300m on Friday.

It is worth noting that a new policy setting schedule will take place from 6 August, when the policy announcement, minutes and Inflation Report will be released at the same time. This information deluge in August may result in some volatility.

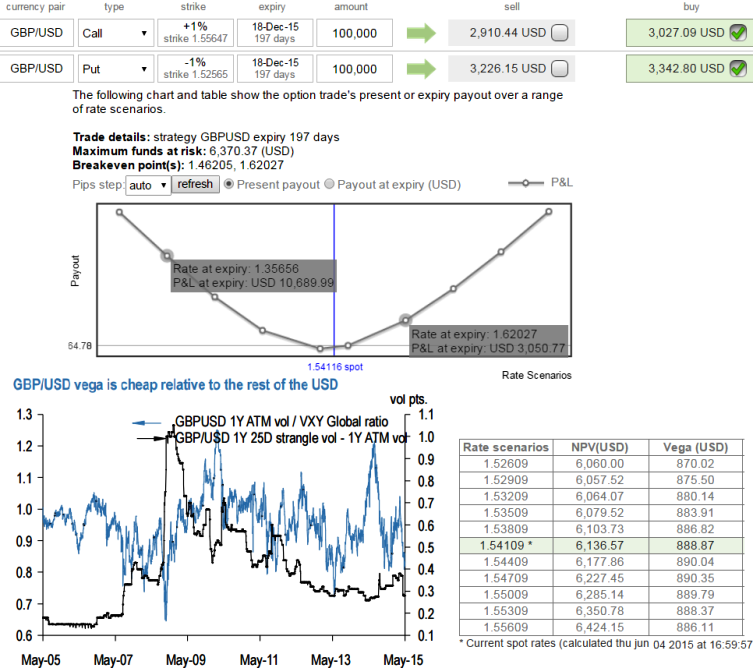

On a long term hedging perspective, Long Vega GBP/USD strangles is recommended.

Long GBP/USD strangles: long OTM Calls (strike at 1.5570) and OTM Puts (1.5261) for a net debit at USD 6370.74.

The decline in back end (6M) GBP vols below 8.0 following the surprise UK election results had erased their entire YTD rally, and qualifies in our view as an over-reaction when realized vols are comfortably running at a 8%-9% pace even after the passage of election risks.

Owning longer-dated GBP/USD vega not only allows participation in a broad dollar/dollar vol surge later in 2H closer to Fed tightening but also any medium-term GBP-weakness stemming from a more strident tone to a Brexit campaign.

Cheaper Vega on GBP/USD strangles

Thursday, June 4, 2015 11:51 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?