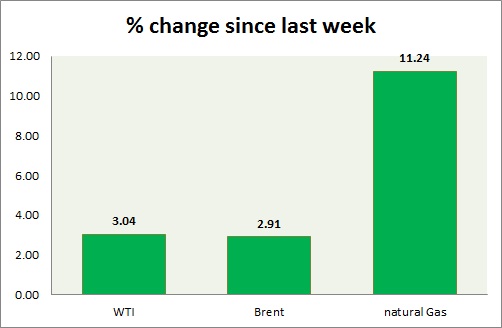

Energy pack is having another positive day. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI made lower high today, clinging away once more from the doji high. Today's range $61.6 -60.4.

- Target for the downside is coming around $50-51/barrel if doji high is not taken out at $62.7. A break above could push prices as high as $70/barrel. $75/barrel remains next target.

- Yesterday, EIA report showed crude inventory decreased by 6.8 million barrels.

- WTI is currently trading at $60.7/barrel. Immediate support lies at $56-54.6, $51.2-50 and resistance at $63-$65.

Oil (Brent) -

- Brent is struggling similar to WTI to break free of the range. Today's range $66.1- 64.7

- Brent-WTI spread lost 20 cents, currently trading at $4.3/barrel.

- Target is coming around $55/barrel, is doji high is not taken out. A break would push it towards $80/barrel.

- Brent is trading at $65/barrel. Immediate support lies at 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas came a long way from the low around $2.55/mmbtu, now faces crucial test over inventory report. It is no doubt, if inventory rise lower than expected it would push prices higher, however if price can rise even if inventory moves up, then it would surely rise further to reach the long awaited target.

- Price tested the resistance around $2.93 once again today.

- Price target for bulls are coming close to $3.5/mmbtu, should support at $2.45 holds.

- Natural Gas is currently trading at $2.88/mmbtu. Immediate support lies at $2.45 area & resistance at $2.93, $3.04, $3.32.

|

WTI |

+3.04% |

|

Brent |

+2.91% |

|

Natural Gas |

+11.24% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary