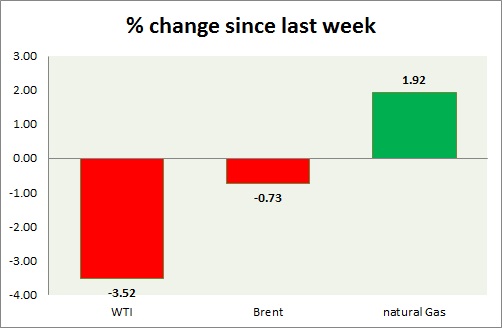

Energy pack is trading in red. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI got support from weaker non-farm payroll data. Today's range $57.7-56.7

- Target for the downside is coming around $50-51/barrel if doji high is not taken out at $62.7. A break above could push prices as high as $70/barrel. $75/barrel remains next target.

- WTI is currently trading at $57.6/barrel. Immediate support lies at $56-54.6, $51.2-50 and resistance at $63-$65.

Oil (Brent) -

- Brent is gaining against WTI as better demand from Asia keeps the benchmark buoyant. Today's range $61.9-62.9

- Brent-WTI spread gained 70 cents today, currently trading at $5.2/barrel. Spread might rise faster if Iran deal remains eluded beyond 9th July.

- Target is coming around $55/barrel, if doji high is not taken out. A break would push it towards $80/barrel.

- Brent is trading at $62.5/barrel. Immediate support lies at 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas is struggling to clear resistance at $2.85 resistance. Price might target $3.1/mmbtu and $3.5/mmbtu area if support holds at $2.7 and $2.45/mmbtu.

- EIA to declare inventory at 14:30 GMT.

- Natural Gas is currently trading at $2.82/mmbtu. Immediate support lies at $2.7, $2.45 area & resistance at $2.85, $2.93, $3.04, $3.32.

|

WTI |

-3.52% |

|

Brent |

-0.73% |

|

Natural Gas |

+1.92% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings