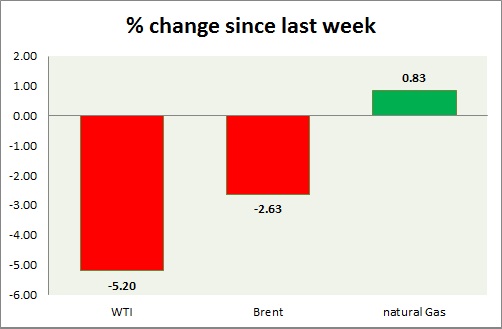

Energy pack is trading in red today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI further dropped as rigs count increased in US for first time since December. Today's range $56.8-56.2

- Target for the downside is coming

around $50-51/barrel. WTI is on its way to weakest close in 9 weeks. - WTI is currently trading at $56.3/barrel. Immediate support lies at $56-54.6, $51.2-50 and resistance at $63-$65.

Oil (Brent) -

- Brent is holding on to support as WTI dropped. However is likely to break. Today's range $61.3-62

- Brent-WTI spread lost 20 cents today, currently trading at $5/barrel. Spread might rise faster if Iran deal remains eluded beyond 9th July.

- Target is coming around $55/barrel, since doji high is not taken out for that Brent needs to break below $61.

- Brent is trading at $61.3/barrel. Immediate support lies at 61.8-61.3 area and resistance at $ 65 region.

Natural Gas -

- Natural failed to clear resistance at $2.85 resistance. Price might drop since resistance was maintained.

- EIA report showed inventory rose by only 69 billion cubic feet.

- Natural Gas is currently trading at $2.79/mmbtu. Immediate support lies at $2.7, $2.45 area & resistance at $2.85, $2.93, $3.04, $3.32.

|

WTI |

-5.20% |

|

Brent |

-2.63% |

|

Natural Gas |

+0.83% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings