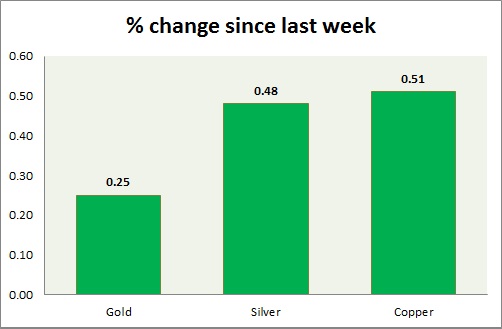

Metals performance is lacklustre despite weaker dollar. Performance this week at a glance in chart & table -

Gold -

- Gold is up today, but dropped sharply below $1200 mark yesterday. Likely to consolidate ahead of NFP report.

- Gold might reach $1252 area, if $1224 area gets broken and risks trading as low as $1152 if $1178 support gets broken.

- Gold is currently trading at $1193/troy ounce. Immediate support lies at $1178 and resistance at $1224, $1236-1240 area.

Silver -

- Silver wasn't able to hold on to gains above $17 mark, dropped sharply yesterday. However weaker dollar is providing some support.

- Mint ratio is up by -0.17% today, currently at 71.1. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.78/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- Copper bounced back amid weaker dollar, but risks falling further.

- Bears are likely to retain control, unless $2.95 breaks.

- Copper is currently trading at $2.74/pound, immediate support lies at $2.65 & resistance at $2.84, $2.89, $2.95.

|

Gold |

+0.25% |

|

Silver |

+0.48% |

|

Copper |

+0.51% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary