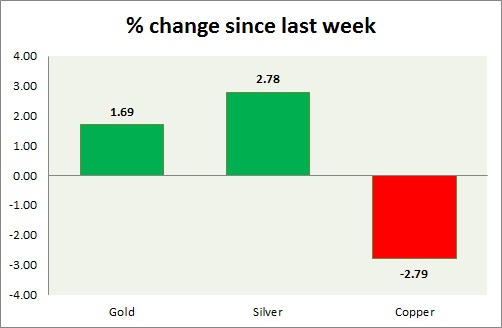

Precious pack is up post dovish FOMC, industrial lagging. Performance this week at a glance in chart & table -

Gold -

- Gold is trading back above $1200, however conviction is clearly lagging.

- Weaker dollar might prompt further rise and test of resistance at $1224 area.

- Gold is currently trading at $1201/troy ounce. Immediate support lies at $1172, $1152 and resistance at $1224, $1236-1240 area.

Silver -

- Silver is likely to trade in range of $15.4 to $17.5, since conviction is clearly lagging.

- Mint ratio is up by 0.2% today, currently at 73.8. Mint ratio and precious metal prices are inversely related more often than not.

- Weak dollar is providing the necessary support.

- Silver is currently trading at $16.4/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- Copper failed to gain traction over weak dollar and dovish FOMC, traded as low as $2.61/pound.

- Next target is around $2.52/pound since support at $2.65 got broken.

- Copper is currently trading at $2.61/pound, immediate support lies at $2.5 & resistance at $2.75, $2.84, $2.89, $2.95.

|

Gold |

+1.69% |

|

Silver |

+2.78% |

|

Copper |

-2.79% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings