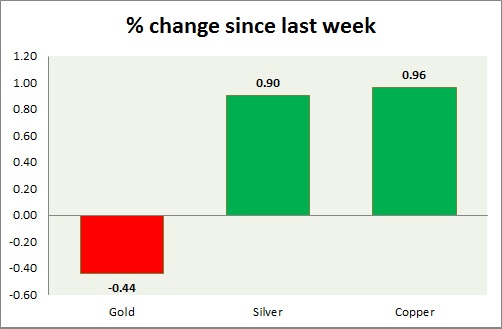

Metals are trading on positive note ahead of FOMC today. Performance this week at a glance in chart & table -

Gold -

- Gold is hovering close to $1100 mark and focus remains on FOMC for further guidance. Today's range - $1100-$1090.

- Gold is likely to trade with downside bias, however a sustained push below $1050 is unlikely

- Gold is currently trading at $1094/troy ounce. Immediate support lies at $1060 and resistance at $1120 area.

Silver -

- Silver is trading in small range ahead of FOMC, however remains better performer than gold. Today's range $14.92-14.6

- Silver was sharply rejected around $15 area.

- Silver is currently trading at $14.75/troy ounce. Support lies at $14 & resistance at $16. $15 is likely to pose interim resistance, whereas $14.5 remains interim support.

Copper -

- Copper gained ground today, as Chinese market stabilized over government intervention. Today's range $2.45-2.39.

- Next target is around $2.24, however correction might be larger.

- Copper is currently trading at $2.41/pound, immediate support lies at, $2.2 & resistance at $2.65.

|

Gold |

-0.44% |

|

Silver |

+0.90% |

|

Copper |

+0.96% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings