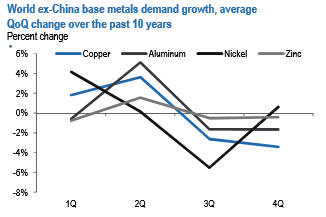

Over the past 10years, quarterly data show that on average global demand across the base metals we cover has increased between 2.5% and 11% QoQ in the second quarter (refer above chart). With the exception of nickel, average QoQ demand growth in 2Q is by far the strongest of any quarter, particularly for aluminum and copper at 6% and 11% QoQ, respectively.

As with many dynamics in industrial metals, seasonality in global demand (weak Q1 followed by a strong Q2) has been increasingly shaped by China, given it accounts for nearly half of all metals demand.

More specifically, as the Chinese New Year holiday either falls in January or February, Chinese demand seasonality is characterized by very soft demand in 1Q followed by a stark incremental pickup in industrial metals activity in 2Q (refer above chart).

That being said, while ex-China demand follows a different seasonal pattern overall—generally stronger quarterly growth in 1Q than China with weaker growth in 3Q and 4Q—average QoQ demand growth for copper, aluminum, and zinc over the last 10years is still the strongest in 2Q outside of China as well (refer above chart).

As you can see from the exhibits, the one exception is nickel, which generally exhibits the strongest quarterly demand growth in 1Qs and the weakest in 3Qs due to the operational seasonality of stainless steel mills.

Refocusing on the point made above about China’s increasing influence on global demand seasonality, over the past three years China alone has on average accounted for nearly 80% of the global QoQ demand growth experienced in the second quarter for both copper and aluminum. Put another way, global copper demand in the second quarter grew nearly 570kmt QoQ on average in the last three years (2014-2016) with Chinese growth alone in 2Qs contributing nearly 450 kmt of that quarterly growth. Aluminum displays a similar trend with global 2Q QoQ demand growth averaging close to 1,500 kmt over the last three years and Chinese growth contributing 1,150 kmtof that alone.

To summarize, Chinese demand growth takes center stage even more than usual in 2Q, which keeps us constructive, given that all the underlying indicators for Chinese metals demand growth next quarter look positive.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary