Dollar index trading at 96.65 (+0.07%)

Strength meter (today so far) - Aussie -0.47%, Kiwi -0.29%, Loonie +0.28%.

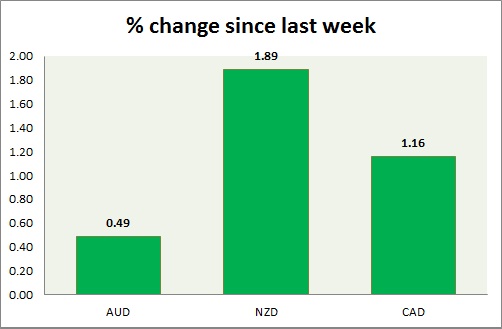

Strength meter (since last week) - Aussie +0.49%, Kiwi +1.89%, Loonie +1.16%.

AUD/USD -

Trading at 0.731

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.75

Economic release today -

- NIL.

Commentary -

- Aussie is down against dollar, heading into FOMC meeting today. Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.67

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Buy support

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- Building permits scheduled at 22:45 GMT.

Commentary -

- Though trend remains bearish, long Kiwi, with 0.65 as support in the shorter term. FOMC is likely to provide further guidance.

USD/CAD -

Trading at 1.289

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.265

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.30

Economic release today -

- NIL

Commentary -

- Canadian dollar remains sell against dollar, the pair might reach as high as 1.38. However loonie gained grounds today against dollar as oil price bounced back sharply over EIA report showing reduction in inventory. Loonie stands as the best performer today.