Long term FX hedging insights: AUD/USD

The prevailing price of Aussie dollar is around US$0.7830.

Risk free rate is around 2% and 0.25% in Australia & the US respectively.

The market price of At-The-Money call option of AUD/USD with strike price at 0.7831 and 1Y maturity is trading at US$ 532.17.

Smaller gamma signifies delta is less likely to change which means that underlying position does not act severely.

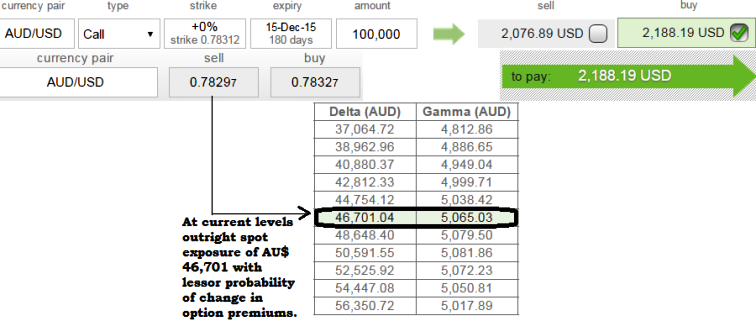

As shown in the figure, delta is at 0.46 and gamma at 5065.22.

Thus, this ATM call ensures underlying holdings around 46,000k with least likely change in option premiums as gamma is at its low.

We feel on hedging grounds these instruments at current levels are good buy.

Derivgam signifies ATM AUD/USD call with 6M maturity placed in haven

Thursday, June 18, 2015 10:58 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand