The euro zone economy is expected to post another firm growth in Q2 having extended by 0.4% in Q1 but streets are likely to disregard as they were not suffice on Greece turmoil still hangs on.

Industrial production data for April will help gauge the extent of the improvement in the activity outlook at the start of Q2.

On balance, a firm overall print still seems likely and we look for euro area industrial output to have risen by 0.4% in April.

Regional outturns have been mixed with stronger-than-expected readings from Spain and Germany offset by disappointing outturns from Italy and France.

Currency Option Strategy:

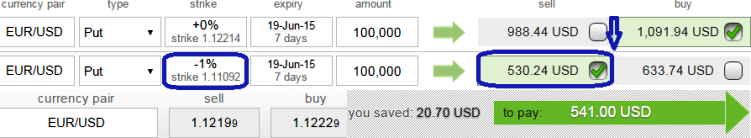

The current EUR/USD diagonal bear put spread strategy allows a reduction in hedging cost almost about 50% by writing a put with short duration of expiry.

As demonstrated in the above instance, buying near month At-The-Money put contract and simultaneously writing a near-month Out-Of-The-Money put of EUR/USD pair is reducing US$ 561. (i.e. almost more than 50% cost of a naked put alone).

Hence, on hedging grounds we advocate 2M longs on ITM +0.65 delta puts (strike at 1.1344) and equal numbers of shorts on 7D OTM puts (strike at 1.1088) with close to +0.5 theta.

Diagonal EUR/USD Put Spreads reduce 50% of naked puts hedging cost

Friday, June 12, 2015 6:39 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand