At the European Central Bank's (ECB) Governing Council meeting on Thursday, 20th October, no changes in policy rates are expected. However, an announcement of QE beyond March 2017 cannot be ruled out. A decision regarding an eventual exit scenario will likely be taken in December.

Analysts expect the central bank to keep policy unchanged and wait until December to unveil a possible extension and tweaks to its Quantitative Easing programme. President Mario Draghi's presser will be scrutinized closely as investors assess both the scope for further easing and eventual tapering.

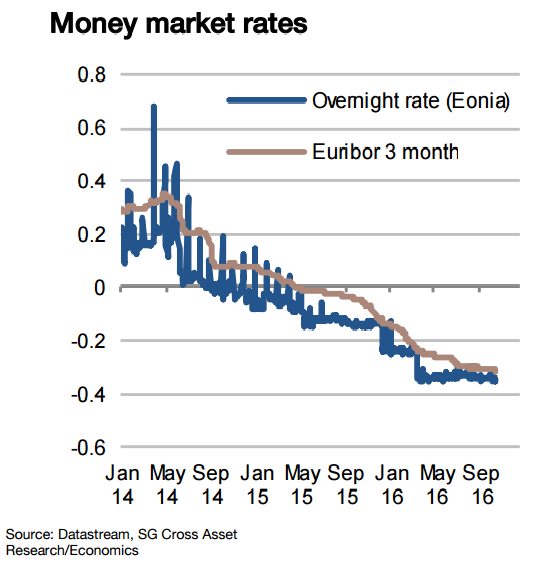

Based on current economic developments and outlook, there is no obvious case for additional easing, with headline inflation expected to rise strongly over the coming six months. Recent data continue to point to a weak but resilient recovery in the euro area, which suggest the ECB should largely maintain September forecasts intact.

ECB chief Mario Draghi will be under pressure this week to clarify the bank's stimulus plans after talks of possible stimulus taper spooked investors. The ECB strongly denied the speculation but markets were rattled nonetheless. Despite some positive signals in recent months, Eurozone growth has remained sluggish and inflation stubbornly low. The ECB targets an inflation rate of "below, but close to" two percent - a level which it has not hit since the beginning of 2013.

"No changes in policy rates, APP or liquidity provision. We expect the APP to be extended in December, with the issue limit increased up to 50% to enlarge the available universe of bonds," said Societe Generale in a report.

EUR/USD was trading at 1.09 at around 12:00 GMT. Major support seen at 1.0970 (trend line joining 1.09638 and 1.09701), while major resistance lies at 1.1010 (trend line joining 1.10576 and 1.10242). The intraday trend is bearish as long as resistance 1.1010 holds. Any break above 1.1010 will take the pair to next level till 1.10580/1.10750 in the short term. On the lower side, any break below 1.09700 will drag the pair down till 1.09100/1.08350.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom