Reserve Bank of India (RBI) governor Raghuram Rajan, who is an eminent economist, known as Paul Volcker of India (inflation slayer) and among the few who has warned on 2008/09 financial crisis upfront, has been shouting against the rising NPA's of Indian banks and warning the government against supporting the already vulnerable.

And he is right, vulnerability of one sector can make other sectors too, who have great exposure to that one. Indian banks are classic example of such a case.

India has remained an investor darling this year among emerging markets, received high amount of FDI and more likely to follow. World Bank has pushed India four notch higher in its ease to do business rating but all that might fall in jeopardy, if India's corporate vulnerability give rise to a banking crisis.

Rise of NPAs and concentration of risks remain Indian banks' two of the biggest threats, thanks to overleveraged corporates. If measures are not taken to check these issues, a banking crisis might be under way.

Level of exposure and concentration -

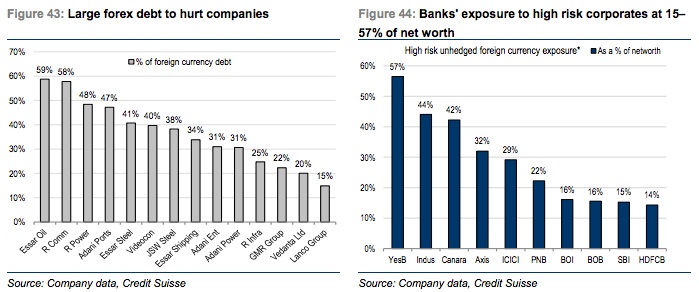

Detailed research from shows how exposed are the banks to these high risk corporates. Companies like Essar oil, Reliance Communication, Reliance Power, Adani Ports have high level of foreign currency debt in their portfolio (close to 50% and for some beyond).

And banks have very high exposure to these corporates as a percentage to their net worth. These exposure range from 14%( HDFC bank) to 57%( Yes bank). Many banks like IndusInd, Axis, Canara, ICICI have exposure close to or above 30%.

RBI, government and the companies need to work together to resolve the issue fast or risk greater damage.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand