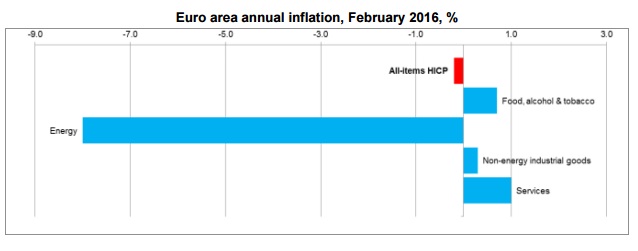

Euro Zone is back to deflationary territory after long four months as price declined to -0.2% y/y in February, according to flash reading. Median expectation was that price would remain at same level as January. Core consumer prices declined too and growth was just 0.7%, compared to 1% last month. Monthly reading was worse, price declined by -0.4%, well below -0.1% expected.

Energy prices proved to be major drag, which dropped -8% and probably sipping in to core measures as well. Services inflation has been highest at 1% but that is also well be low European Central Bank's target of 2% around inflation broadly.

Expect heated debate on March 10th, when governing council members meet to discuss policy. ECB in its previous monetary policy announcement indicated further actions might be coming in that meeting as ECB reassess current policy and possibly readjust it.

While German hawkish Bundesbank indicated that ECB staff might have to revise inflation projections much lower, in last G20 meeting, German finance minister indicated no fiscal stimulus and voiced for reforms instead of actions by monetary policy.

Due to recent weakness in reading, Euro has been slowly grinding lower and currently trading at 1.091 against Dollar, down -0.21% for the day so far.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX