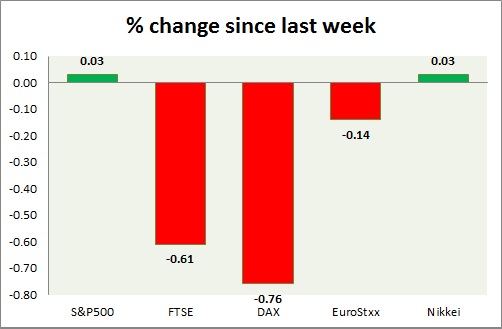

Equities are red across globe today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is down as weaker factory orders pose doubts on US economic strength.

- ISM New York came at 54 in May, lower than prior 58.1.

- TIPP economic optimism came at 48.1, lower than prior 49.7.

- Factory orders dropped -0.4% m/m in April.

- S&P 500 is currently trading at 2109. Immediate support lies at 1980, 2040, 2080 and resistance 2164.

FTSE -

- FTSE is trading flat today. Better than expected construction PMI at 55.9 for May provided the necessary support. FTSE covered initial loss sharply. Today's range 6972-6872.

- FTSE is currently trading at 6952. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX faced high volatility today. Today's range11467-11270. German employment increased by 6000, unemployment rate at 6.4% for April.

- Larger buy trend remains in place. Upside target is coming at 12600-12700 with stop at 11100. A break would lead DAX lower to touch 10550 area.

- DAX is currently trading at 11350. Immediate support lies at 11250 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are all mixed today. Bears are still retaining control.

- Germany is down (-0.73%), France's CAC40 is down (-0.18%), Italy's FTSE MIB is up (+0.66) and Spain's IBEX is up (+0.60%).

- European inflation quickened in May by 0.9% y/y for core and 0.3% y/y for headline.

- EuroStxx50 is currently trading at 3571, down 0.45% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Nikkei has retreated from high as Yen grew stronger against dollar.

- Further rise is likely.

- Nikkei is currently trading at 20443. Key support is at 20200, 19500 and resistance at 20900 area.

|

S&P500 |

+0.03% |

|

FTSE |

-0.61% |

|

DAX |

-0.76% |

|

EuroStxx50 |

-0.14% |

|

Nikkei |

+0.03% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary