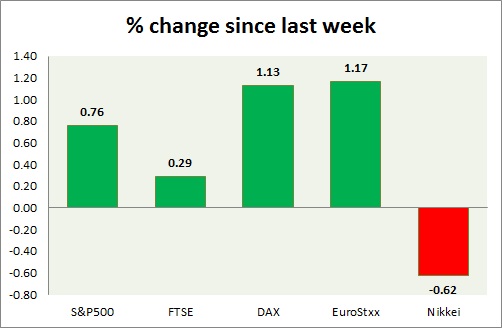

Equities are trading in green today as risk aversion subsided further. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is back above 2100 mark. Today's range 2115-2104.

- Headline retail sales grew by 1.2% m/m and 5.2% from a year ago. Sales excluding autos rose 1% m/m.

- Initial jobless claims came at 279,000, continuing claims rose to 2.265 million.

- S&P 500 is currently trading at 2110. Immediate support lies at 1980, 2040 and resistance 2164.

FTSE -

- FTSE bounced back, however performance is lacklustre amid stronger pound. UK sold 10 year bond at 2.86% compared to 2.34% prior. Today's range 6870-6807.

- FTSE is currently trading at 6840. Immediate support lies at 6700 and resistance at 7120.

DAX -

- DAX has bounced back sharply as long term buyers rushed in to take positions after 10% correction, however it is too early to say that DAX has erased short term downside bias.

- DAX is likely to move towards 10550 area, since 1100 mark was broken. However DAX remains fundamental buy.

- DAX is currently trading at 11310. Immediate support lies at 10500 and resistance at 11500 around.

EuroStxx50 -

- Stocks across Europe are all trading in green today. Risk aversion subsided.

- Germany is up (+0.8%), France's CAC40 is up (+1.7%), Italy's FTSE MIB is up (+1.72%) and Spain's IBEX is up (+1.03%).

- EuroStxx50 is currently trading at 3550, up 0.7% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Nikkei moved into green as Yen lost grounds against dollar. Market is now looking beyond Governor's Kuroda's comments.

- Nikkei is currently trading at 20430. Key support is at 19500 and resistance at 20900 area.

|

S&P500 |

+0.76% |

|

FTSE |

+0.29% |

|

DAX |

+1.13% |

|

EuroStxx50 |

+1.17% |

|

Nikkei |

-0.62% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary