ECB's decision to introduce QE at the start of the year had been a game changer for the EUR. Between the middle of December 2014 and early March 2015, EUR/USD dropped around 16.8% to a low of around 1.046. The weeks ahead will bring not just the December FOMC but an ECB meeting. The world's top two central banks are set to face periodic market jolts as they move in opposite policy directions.

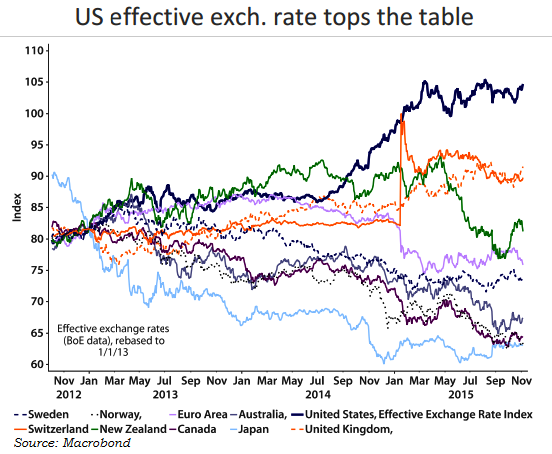

Interest rate futures point to a 66 percent probability that the Fed will raise rates at its December 16-17 meeting, putting policy divergences between it and other big central banks firmly in play. Fed's hike is likely to be followed by the BoE sometime next year. All G10 central banks with the exception of the BoE and the Fed have either cut interest rates or maintained a QE programme. Going forward there is a good chance of further easing from the BoJ, RBA, RBNZ, Norges Bank, SNB and the Riksbank. USD is poised to move higher unless the FOMC counters the build-up of long USD positions with a paring back of hawkish commentary.

"The monetary policy of other jurisdictions is an external factor that we can't influence. It's like the weather, we factor it in but it's a given. It of course matters, it's like the exchange rate, it has an impact as a policy variable so you factor it into the outlook." said ECB Governing Council member Ardo Hansson

EUR/USD plunged to its lowest level since April on the back of US employment data last week which included not just a strong headline number for payrolls but strength in earnings and a drop in the jobless rate. EUR is down by more than 5 percent against the dollar in a matter of weeks, and this is unlikely to be last sharp market move as a number of leading central banks act. The move has caused analysts to reassess the medium-term target for the pair. There is every reason to suspect that the move in EUR/USD over the next few months will not be linear and that parity in EUR/USD could still be further away than it currently appears.

"Forecasters struggled to keep pace with the sharp decline in the EUR. Unlike many, however, we decided at the start of the year against putting parity on our forecast table. We remain reluctant to forecast parity for EUR/USD though the outcome of the central bank meetings in December could change this view", says Rabobank in a research note to its clients.

EUR/USD fell below $1.07 to hit low of $1.0694, down 0.5 percent on day after ECB's Draghi said indications that inflation will recover are weakening. The remarks address a key barometer of economic health that is used to determine what further action, if any, the ECB will take to ease monetary policy.

Euro-Dollar Parity Back On Cards?

Thursday, November 12, 2015 10:25 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary