Having fallen sharply in early July, spreads on peripheral European bonds have moved sideways to higher over the past month. The lack of further improvement has occurred despite continued progress in negotiations over a third bailout package for Greece. Recent reports suggest a deal has been struck. If ratified, this will give Greece access to up to €90bn of extra funding. This should allow Greece to make the 20th August debt repayment to the ECB. Longer-term risks for Greece's euro membership remain, however, given an expected sharp economic contraction this year and a rapidly deteriorating debt profile.

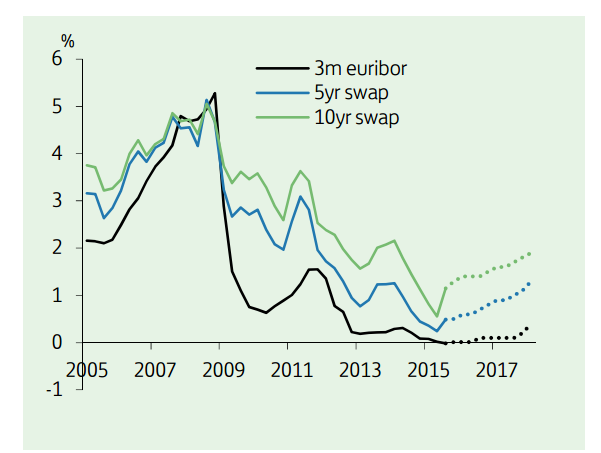

Economic indicators for the euro area as a whole suggest that the more positive momentum at the start of the year has been maintained. The Greek crisis has seemingly had little impact on business confidence. Notably, the upswing in the euro area manufacturing and services PMI surveys remained intact, while strong German factory orders are a further positive sign for activity in the second half. Euro area headline inflation remained unchanged at 0.2%, but core inflation excluding food and energy picked up to 1.0%, the highest level for 15 months. Nevertheless, with ample spare capacity in the euro area economy and unemployment still in double digits, headline inflation next year is expected to remain below the ECB's target of close to but below 2%. With the economic recovery also relatively fragile, the ECB is expected to implement fully its asset purchase programme, scheduled to be completed at the end of September 2016.

"We maintain our expectation that short-dated German bund yields will remain anchored at low levels, with the 2-year yield staying in negative territory this year. Our forecast for the 10-year bund yield is also unchanged and is targeted to rise to 1% by the year end, helped by the start of US policy tightening," notes Lloyds Bank.

Euro area rates review

Thursday, August 13, 2015 12:13 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX