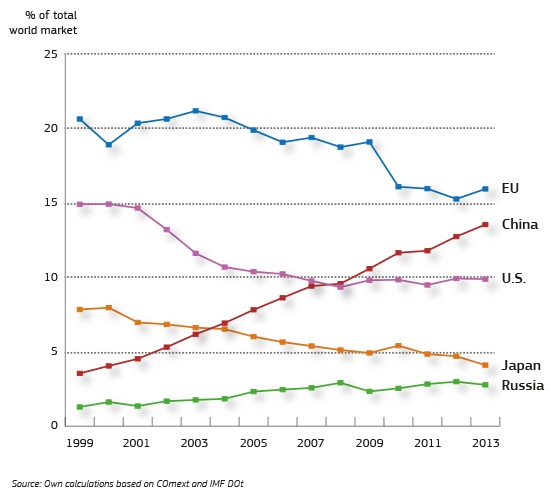

Euro during 2000-2008 saw remarkable rise in its value against other currencies when it rose from below par to 1.6 against dollar. During 2011 Eurozone financial crisis Euro fell close to 1.18 against dollar but that fall due to a question mark over its existence. During the period EU's market share fell from 21% to close to 15% in global export. Chart courtesy European council. This time around the story is different.

- Easy monetary policy by European Central Bank lead to a fall in Euro from 1.40 in 2014 to 1.05 by March 2015. Only a handful of currencies like of Ukraine, Russia fell more than Euro.

The value of Euro is sure to change the balance in world trade.

- China - Remarkable rise of China in world market increased its share in world export from 5% to 15% from 1999. China is to suffer big over the Euro's fall as it runs huge trade surplus with Euro zone which is seeing contraction already. Euro in last 12 months fell 22.5% against Yuan.

- US - US already runs a trade deficit with Europe and it might balloon further with weaker Euro. Us companies might even start facing competition even in own soil.

- Japan - Japan doesn't run much of a surplus in Eurozone but weaker yen advantage is getting eroded with fall in euro. Euro started reversing its gain against Yen. Euro is down against Yen by 11.5% YTD.

- Russia - Russia mainly suffers from sanctions and might lose market share over that. However Russia still has currency advantage as it is stilldown close to 30% against Euro in last 12 month. However it is major exporter of energy, so might not pose much challenges.

European companies would benefit the most over the actions of ECB and fall in Europe. Investors in anticipation of such pouring money in billions to Euro zone equities.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand