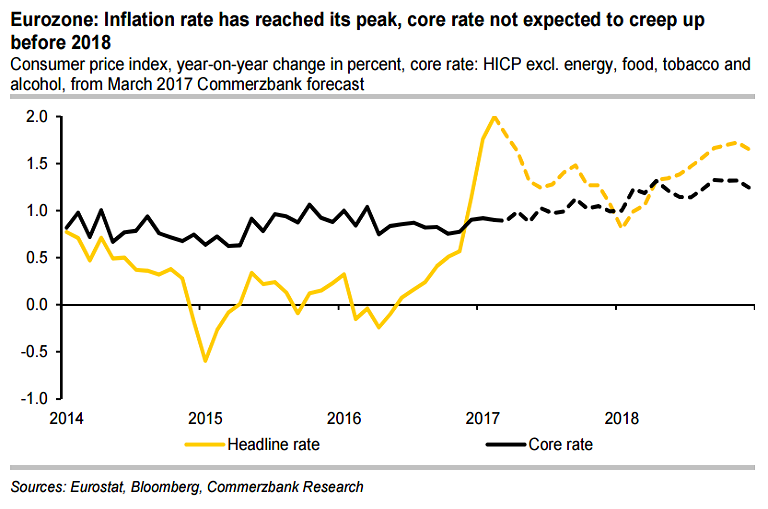

Eurozone inflation has risen above the European Central Bank's (ECB) target rate for the first time in four years, data from statistical agency Eurostat showed on Thursday. Inflation in the 19-nation bloc hit 2 percent in February, up from a rate of 1.8 percent the month before. February's core inflation rate - which strips out the impact of energy and food prices - was unchanged at 0.9 percent.

The increase in inflation is largely due to rising energy prices, and analysts do not expect the ECB to alter its current stimulus programme. Analysts expect the inflation rate to move a bit lower again in spring, and in a few months it is expected to drop back below 1½ percent. Only an increase in the underlying inflationary pressure will send the rate of inflation sustainably higher, which is quite unlikely.

"The rise of the inflation rate to 2.0% in February is likely to further fuel the debate about the ECB soon starting to exit its very expansionary monetary policy. However, the ECB is likely to wait for the rate excluding volatile energy, food, drink and tobacco prices to turn much higher as well," said Commerzbank in a report.

The ECB has maintained an ultra-loose monetary policy to stimulate growth in the eurozone and avoid deflation. In December, the ECB said it would extend its bond-buying programme until at least December 2017, although the €80bn-a-month quantitative easing (QE) scheme will be trimmed to €60bn a month from April.

Solid manufacturing survey data this week suggest the eurozone economy is on course to grow at a robust pace in the first quarter of 2017. Separate jobs data on Thursday showed eurozone unemployment stood at 9.6 percent in January, unchanged from the previous month.

The ECB is due to meet next week to decide monetary policy when it will also publish new growth and inflation projections. Howard Archer, chief UK and European economist at IHS Markit, said: "We believe the ECB will remain wedded to its current monetary policy stance.

EUR/USD was trading 0.32 percent lower on the day at 1.0512 at around 1230 GMT. Intraday bias remains lower. Upside remains capped by 21-4H EMA. Violation there could see upside till 1.0630. FxWirePro Euro Hourly Currency Strength Index was at 17.3106 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady