The turbulent bullion market seems to be quite controlled in European session.

On the Comex division of the New York Mercantile Exchange, gold for August delivery was quoted at $1,174.20 a troy ounce.

Bulls looking to capture the upswings with an optimal entry points so as to reduce cost of trading or hedging.

As stated in our earlier post the forward-looking investors have been questioning whether dollar strength would boost up bull run in precious metal.

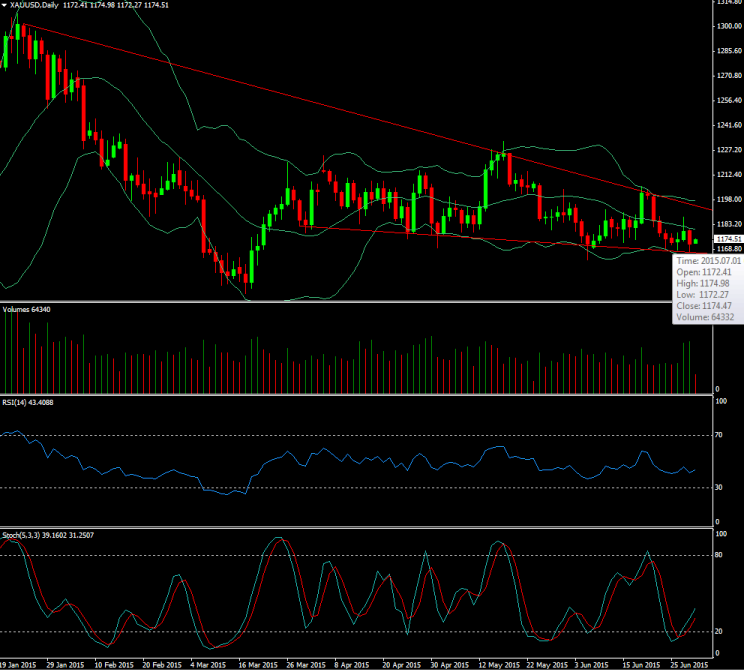

Both on weekly and monthly graphs of this precious metal prices, falling wedge pattern has been spotted out.

Upswings are expected for sure but instant trend reversal still unlikely.

Currently the pair is attempting to test support at around 1170 levels, any breach below 1175 levels can be seen closely when the bulls may gain buying interest at this levels because falling prices have not been confirmed by substantial volumes as shown in the charts.

The falling wedge is usually a bullish pattern signaling that one is about to witness the price break upwards through the wedge and move into an uptrend.

But at this level our cautious call is to look for better entry points that are supported and configured from RSI & stochastic indications as well.

RSI (14) has been converging with sideway price fluctuations, while %K line crossover below 20 level is crucial signal of oversold situation. RSI currently trending at 42.6376 levels and %K line at 37.6302 & %D line at 30.7136 levels.

Expect XAU/USD upswings on Falling Wedge

Wednesday, July 1, 2015 7:58 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings