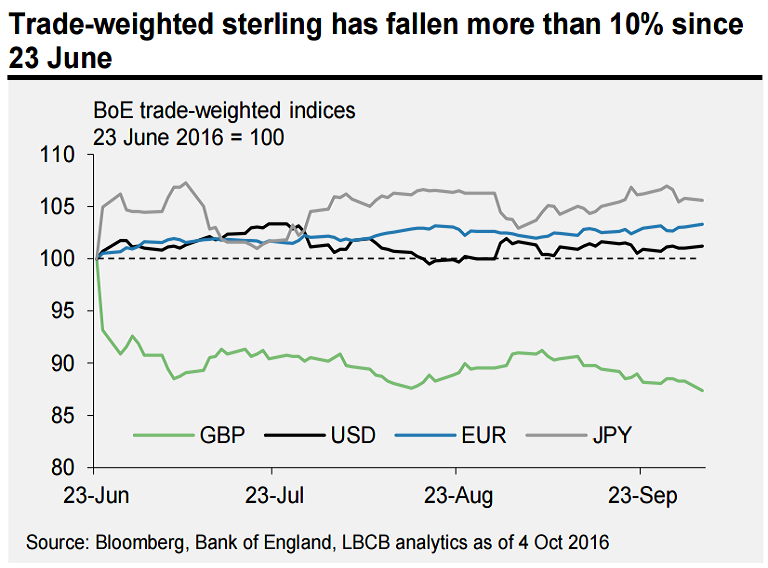

UK Prime Minister Theresa May's announcement to invoke article 50 by March 2017 at the latest, thus starting official exit negotiations has put considerable pressure on the Sterling. Markets are seeing an increased probability of what is widely reported in the media as ‘hard Brexit’. The pound sterling continues to decline, has not recovered after the June referendum vote despite incoming data showing strong resilience.

May said she wanted to give “British companies the maximum freedom to trade and operate in the single market”, but not at the expense of allowing free movement or accepting the jurisdiction of judges in Luxembourg. The European Union, however, sees the free movement of workers and oversight of a single court as indispensable pillars of a common market.

Limiting the freedom of movement is unlikely without May having to accept notable restrictions when it comes to accessing the single market. This is likely to lead to considerable economic effects, dent attractiveness of GBP investments and hence increases fears of a “hard” Brexit. Sterling is likely to remain under pressure until an amicable agreement can be reached in this matter.

Data released earlier today showed UK construction PMI jumped to 52.3 points in September, substantially above and building on to 49.2 in the previous month. The data surprised economists who had forecasted a reading of 49.0. Manufacturing sector activity also surprised the markets to the upside, extending further into the expansion territory, as markets shrug Brexit-related concerns. Data released on Monday showed that UK Markit/CIPS manufacturing Purchasing Managers’ Index (PMI) rose to 55.4 from 53.4 in August, beating expectations for a reading of 52.1.

Upbeat data did little to help improve sentiment around the GBP. Cable broke the low made on July 7th 2016 (Brexit low) and made a fresh record low of 1.2736. EUR/GBP hit fresh multi-year highs at 0.8765. The speculative market positions remain stretched to historical extremes: net speculative shorts are nearly 2 standard deviations above the historical mean. The consensus forecast for the GBP/USD at year-end is 1.27.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient