On Wednesday, March 16, The Federal Open Market Committee releases its policy statement along with updated quarterly forecasts for the U.S. economy, which will be followed by Fed Chair Janet Yellen's press conference at 14:30 GMT. Most analysts surveyed by Bloomberg expect the target range for the benchmark federal funds rates to stay unchanged at 0.25 percent to 0.50 percent.

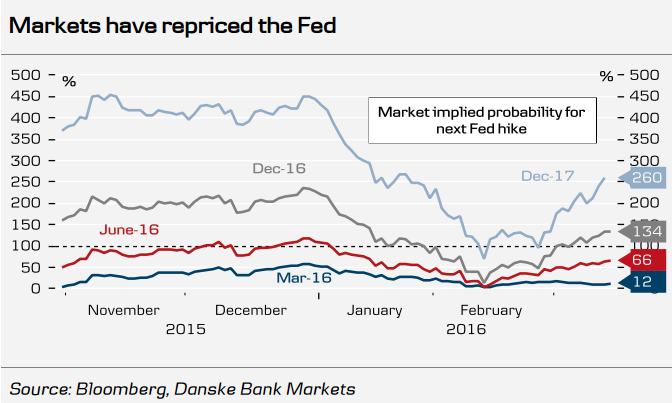

Markets have repriced Fed and now expect two and half hikes by year-end 2017. The next hike is fully priced in for November this year and markets place a 66% probability of a hike in June 2017. Traders expect the funds rate at the March meeting to be little changed from its current on the language in the post-FOMC meeting statement which is expected to indicate that thelevel of 0.36 percent, then rising to 0.46 percent by the June meeting. Markets focus shall remain day for next hike is drawing nearer.

U.S. core inflation was up 1.7 percent in its latest reading, near the Fed's 2 percent target. Also, last week's labour data beat forecasts by about 27 per cent – but other sectors indicate that the US economy is growing moderately and is not as robust as some may think. Productivity in Q4 fell by 2.2 per cent y/y and for all of 2015, productivity rates grew by just 0.7 per cent. The US dollar is also much stronger than last year, making US exports more expensive to international markets. Factor in the slowdown in China and the oil glut and the Fed has reason to be concerned.

The US Federal Reserve must also take into consideration the announcement by the European Central Bank to lower the interest rate last week. If the Fed were to raise interest rates this week, while the ECB lowered them last week, it would create trade disparity and likely make US exports less appealing.

"Our main scenario is that the Fed will stay on hold until September but the probability of a move in June and that the Fed will tighten monetary policy more than once in 2016 has increased due to the rebound in risk sentiment, continued improvement in the labour market and higher PCE core inflation." said Danske Bank in a report.

The euro gained then leveled out against the dollar to close at $1.1154 on Friday. On the day, EUR/USD was trading at 1.1110 at 1200 GMT, while USD/JPY was at 113.77.

Fed likely to be the key driver for G10 FX and US rates this week

Monday, March 14, 2016 12:24 PM UTC

Editor's Picks

- Market Data

Most Popular

9

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal