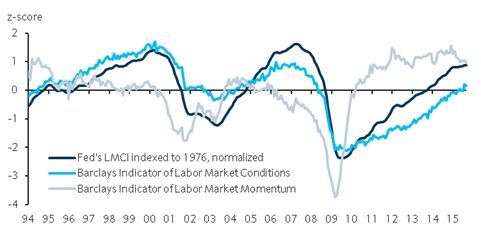

The Federal Reserve's Labor Market Conditions Index (LMCI) rose 0.5 points in November, the seventh consecutive monthly increase but a more modest pace of improvement than in recent months. The October LMCI increase was revised up to 1.5 points (initial: 1.3), in line with the upward revision October payroll growth in last Friday's November employment report (298k, initial: 271k).

November readings of the Indicator of Labor Market Conditions and Indicator of Labor Market Momentum corroborate the view that labor improvement has continued at a moderate pace. Continued employment growth and a declining unemployment rate should reduce what are already low levels of labor market slack, in turn encouraging a modest acceleration in wage growth.

"We expect the Fed's outlook to mirror this line of thinking as the FOMC moves towards lift-off at its meeting next week", says Barclays.

The LMCI uses a dynamic factor model of 19 labor market indicators to extract a single index variable, which is one of the metrics the FOMC uses to assess overall labor market conditions.

"We use changes in the index over the business cycle to understand where labor markets stand. The above figure shows indexes the Fed's LMCI to 1976 to create a level from the reported changes; this series is then normalized to have a mean of zero and standard deviation of one", added Barclays.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed