European Central Bank's (ECB) unprecedented easing, which has unleashed more than €250 billion of liquidity in Euro zone seems to be working its magic for the economy as well as almost all subsectors, as per latest data from Markit economics.

According to sectorial PMI research,

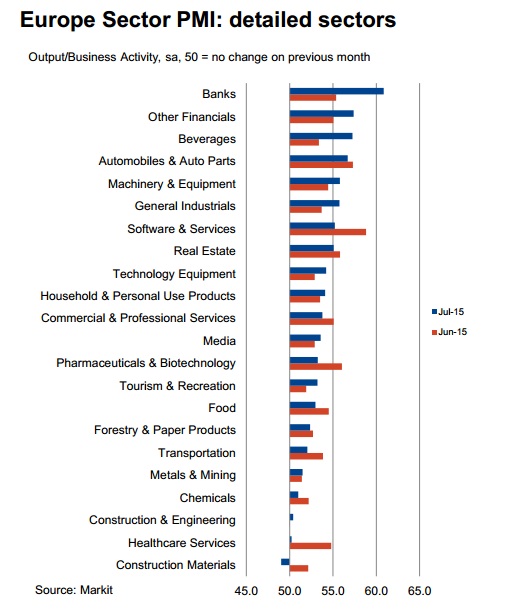

- In July, Banks topped sectorial rankings, suggesting ECB's easing finally sipping into the performance of the sector, which is expecting better business days ahead. Financials were the fastest growing broad sector.

- Data also pointed out that consumers are warming up to better economic days as strong expansion in output were registered in beverages to Automobiles to Tourism.

- Commercial sectors seem to be improving to with expansion seen across industry, with greater expansion for machinery and equipment.

- Construction, however continues to lag and even contracted in July from June.

In spite of rate hike from FED and all global headwinds, European stocks are likely to outperform going ahead, especially after the rate hike from US Federal Reserve.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals