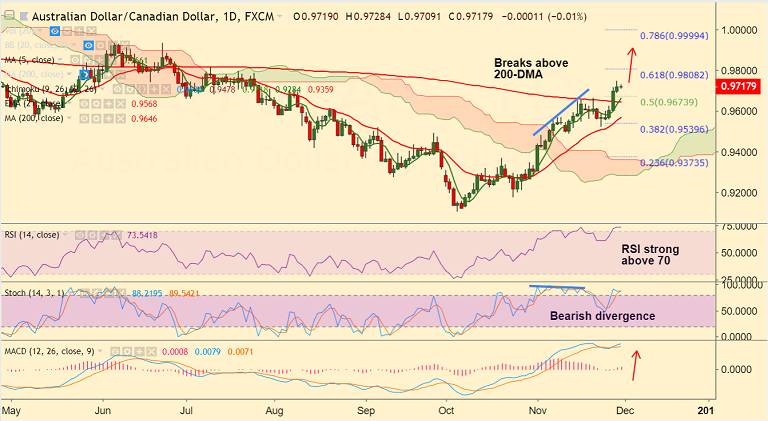

AUD/CAD chart on Trading View used for analysis

- AUD/CAD trades rangebound on the day, markets await Canada GDP data.

- Price action is pausing upside after 5 consecutive sessions of gains.

- Technical indicators support further gains. Stochs and RSI are biased higher, momentum bullish.

- The pair is in a near-term bull trend and breakout at 200-DMA has raised scope for further upside.

- That said, we evidence a bearish divergence on Stochs which dents scope for upside.

- Bias higher as long as 200-DMA support holds. Next major resistance lies at 61.8% Fib at 0.98.

- On the flipside, retrace below 200-DMA could see test of 21-EMA. Violation there to see bullish invalidation.

Support levels - 0.9661 (5-DMA), 0.9646 (200-DMA), 0.9568 (21-EMA)

Resistance levels - 0.9748 (Nov 28 high), 0.9808 (61.8% Fib), 1.00 (78.6% Fib)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed