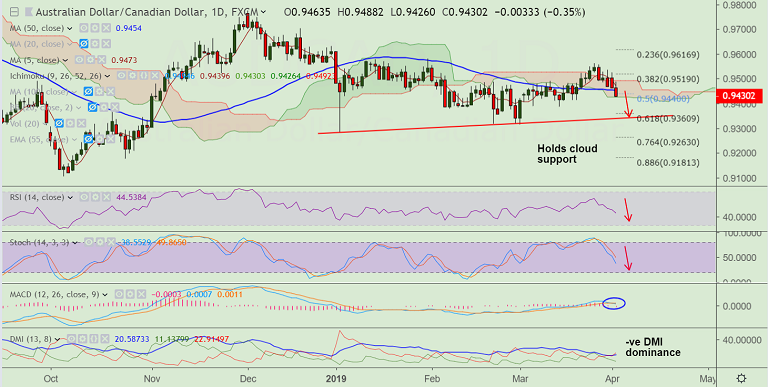

AUD/CAD chart - Trading View

- AUD/CAD has slipped below 50-DMA and s holding support at daily cloud.

- The Reserve Bank of Australia (RBA) held its monetary policy unchanged with an official cash rate of 1.5%.

- The Aussie edged higher as a response, but immediately reversed gains possibly in response to RBA's change in language on the labor market and its impact on wage growth.

- Further decline likely ahead of the pre-election budget (due later today), which is expected to include tax cuts and cash handouts.

- Technicals have turned bearish, Stochs and RSI have turned lower. MACD is on verge of bearish crossover on signal line and -ve DMI is dominant.

- Break below daily cloud confirms further weakness. DIp till 61.8% Fib at 0.9360 likely.

- Retrace above 50-DMA could see bounce till cloud top. Breakout at 200-DMA negates bearish bias.

Support levels - 0.9426 (cloud base), 0.9386 (Mar 14 low), 0.9360 (61.8% Fib)

Resistance levels - 0.9454 (50-DMA), 0.9473 (5-DMA), 0.9519 (38.2% Fib)

Recommendation: Stay short on break below cloud, SL: 0.9455, TP: 0.9385/ 0.9360/ 0.9345

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.