Weekly graph suggests bearish signals as Doji pattern formed when the pair was testing a crucial support at around 91.229 levels on weekly charts. The occurrence of such Doji at this stage to signifies weakness in this pair. Leading oscillators like RSI and slow stochastic curves converging downwards according to the price dips, we believe the breach of this level has set the downward direction of next trend. Currently, the pair managed to take the support at 89.333 levels but its sustenance on closing basis is closely watched today.

Put Ratio Back Spread: AUD/JPY

Rationale: Usually the traders tend to perceive the put ratio backspread as a bearish strategy, because it proportionately employs puts. However, it not only targets bearish trend but actually considers volatility as well. Current implied volatility of AUDJPY being at 10.74% and with the above technical reasoning, we recommend arresting further downside risks of this pair by hedging through Put Ratio Back Spread.

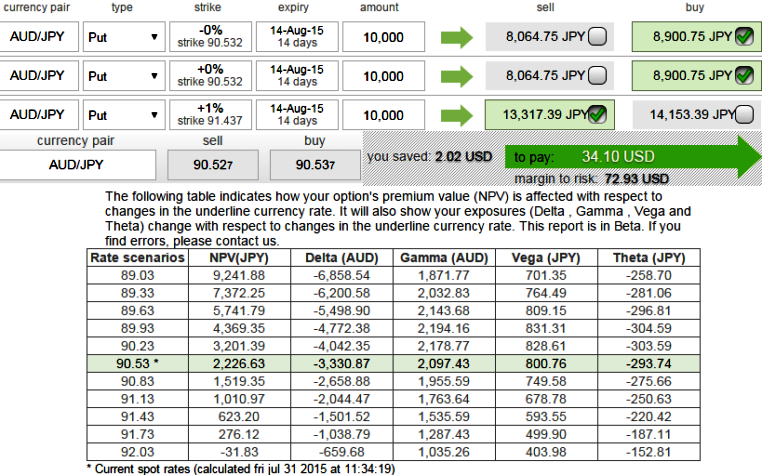

Thus, as shown in the figure purchase 15D 2 lots of At-The-Money -0.51 delta puts and sell 1M one lot of (1%) In-The-Money put option in the ratio of 2:1. Expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside.

The delta of combined positions should be around -0.33 with vega ¥800 and negative theta value. If a disciplined hedger strictly follows all these mathematical computations, then irrespective of market sentiments, one can be rest assured with the riskfree exposures in his foreign trade. Give it an abundant time for expiration so as to make a substantial move on the downside.

FxWirePro: AUD/JPY PRBS for hedging as DOJI breaks support at 91.229

Friday, July 31, 2015 6:11 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings