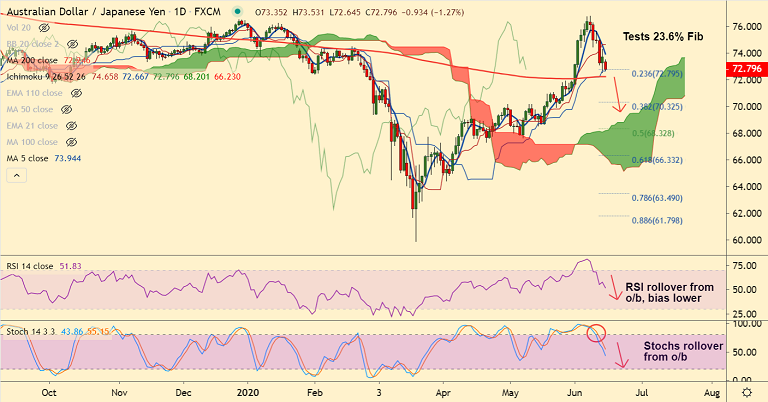

AUD/JPY chart - Trading View

AUD/JPY was trading 0.87% lower on the day at 73.09 at around 09:00 GMT, after closing 0.65% higher in the previous session.

The pair is extending pullback from 12-month highs at 76.788 hit on June 8th and indicators show scope for further weakness.

Stochs and RSI have rolled back from overbought levels and are sharply lower. MACD has made a bearish crossover on signal line.

Price action is above cloud, but Chikou Span has turned bearish, suggesting downside.

Bears have tested 23.6% Fib and are holding support at Kijun Sen at 72.66. Break below will see next major support at 200-DMA.

Violation at 200-DMA will see major weakness. Dip till 50% Fib retracement at 68.32 then likely.

Support levels - 72.66 (Kijun Sen), 72.24 (200-DMA), 71.24 (55-EMA)

Resistance levels - 74.01 (5-DMA), 74.65 (Tenkan Sen), 75.70 (110W EMA)