After the stagnation in April Australia is projected to flash an expansion in May retail sales. Though the MoM growth is probably in line with trend at 0.3% MoM, showing not much of a rebound, this would raise the gain to 4.8% YoY from 4.1% in April.

Even though the disposable income growth in Q1 was just 2.6% YoY, the pace of retail sales growth is exponentially stronger. The degree of weakness in disposable income growth is unlikely to persist in our view.

But on technical charts AUD seems to be still a sell in our view as bearish convergence with falling price on RSI and slumps are in conformity with substantial margins but not on attempts price recoveries.

Slow stochastic evidences still a %D line crossover not above 80's though, selling pressure is clearly seen.

Hence, with a bearish we still recommend debit spreads to hedge further slumps in this pair.

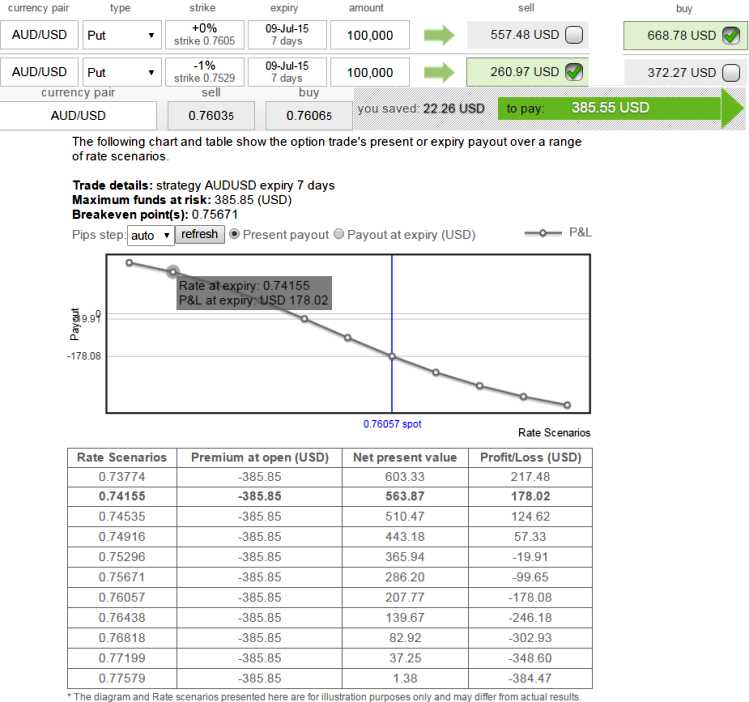

Naked puts are to be avoided as we think NPV of ATM 0.5 puts are trading too costlier premiums. Instead deploy hedging bear put debit spreads.

The strategy reads this way, buy 7D ATM -0.5 delta put option and sell another (-1%) OTM put with the similar maturity for a net debit as shown in the diagram. The spread position should have -0.19 delta value.

FxWirePro: AUD/USD ATM 0.5 delta puts trading at costlier premiums; 19% above NPV

Thursday, July 2, 2015 10:26 AM UTC

Editor's Picks

- Market Data

Most Popular

9

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand