The RBA policy decision is expected to be on hold. The minutes of the April meeting singled out labor and housing markets as key areas being monitored closely. The stronger than expected jobs gains in March and new macro-prudential measures have further cemented the Bank's 'on hold' position.

China: The Apr Caixin Manufacturing PMI remained elevated at 51.2 in Mar but also indicated slower expansion relative to previous months. The Caixin index has been consistent with the NBS PMI which fell 0.6pts from near 5y peaks to 51.2 in Apr.

AUDUSD medium term perspectives: Although the pair bounces off the 0.7450, the upside area should be limited to 0.7600.

The modestly weaker than expected Australian CPI outcome has added yet another factor capping the A$: softer commodity prices; a more protectionist stance from US President Trump, and higher US yields if the Fed raises rates in June as we expect.

These leave the A$ with strong resistance at 0.76. We expect to see it heading towards 0.74 by year end.

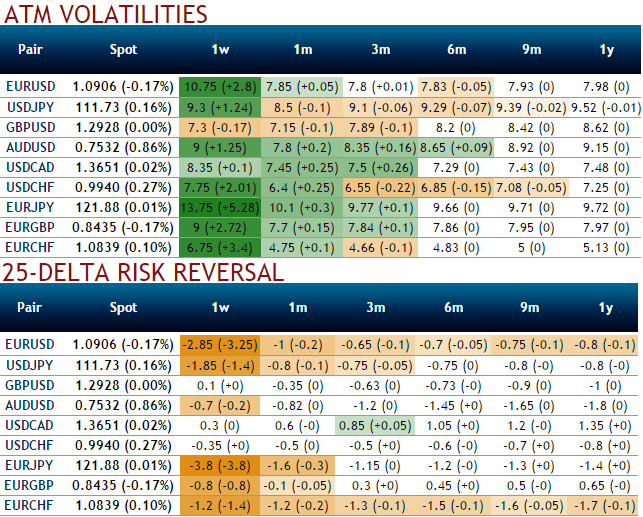

While delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.74-75 or below technical levels. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 1-3m risks reversals that would encompass Fed’s June meeting.

AUDUSD's higher IV with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data