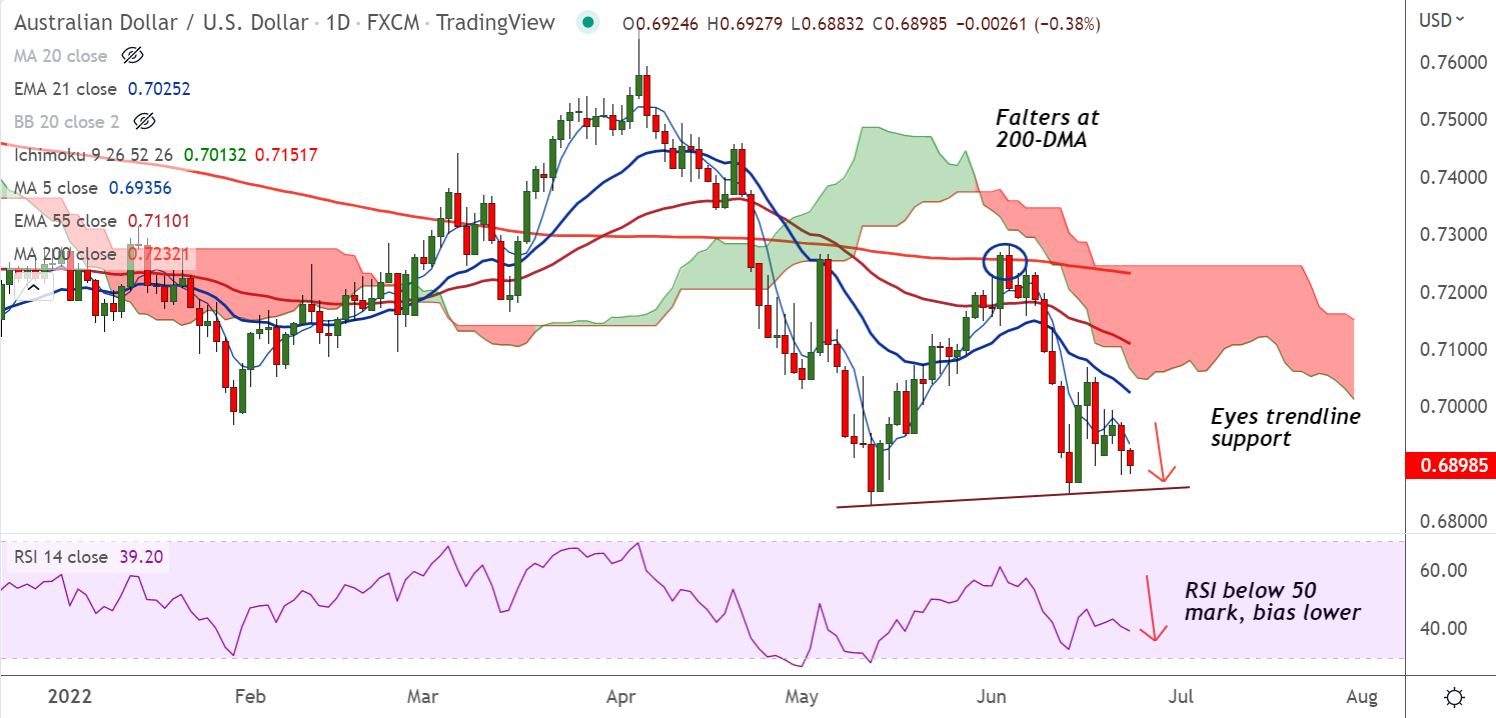

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.44% lower on the day at 0.6894 at around 06:00 GMT

Previous Week's High/ Low: 0.7069/ 0.6850

Previous Session's High/ Low: 0.6972/ 0.6881

Fundamental Overview:

The Australian dollar largely ignores upbeat Purchase Managers Index (PMI) data reported by the IHS Markit.

Australia Services PMI printed at 52.6, significantly higher than the expectations of 49.1 but lower than the former figure of 53.2.

The Manufacturing PMI stood at 55.8, higher than the consensus and the prior print of 54.7 and 55.7 respectively.

Investors remain concerned about the risks of a global recession amid aggressive central bank rate hikes, keeping broad sentiment fragile.

Technical Analysis:

- AUD/USD trades below major moving averages which are trending lower

- GMMA indicator shows major and minor trend are bearish

- Volatility is high and momentum is bearish

- Price action is below cloud and Chikou span is biased lower

Major Support and Resistance Levels:

Support - 0.6850 (June 14 low), Resistance - 0.6935 (5-DMA)

Summary: AUD/USD trades with a bearish bias. The pair is on track to test trendline support at 0.6855 ahead of June 14th low at 0.6850.