All eyes on Greece but the Euro group again failed to reach an agreement on Thursday. The concerns over the current deadlock in Greek debt negotiations weighed heavily on equity markets and as investors eyed fresh talks due to take place later in the day.

Greece has an obligation to repay €1.6 billion to IMF on or before June 30 or face debt defaults which is mounting Grexit pressure and we continue to recommend below strategy on hedging grounds, the pair is likely to sense little bearish downside risks, so let's stay cautious and in order to arrest these bearish risks diagonal spreads using In-The-Money and Out-Of-The-Money put options are advocated.

Currency Option Insights: EUR/JPY

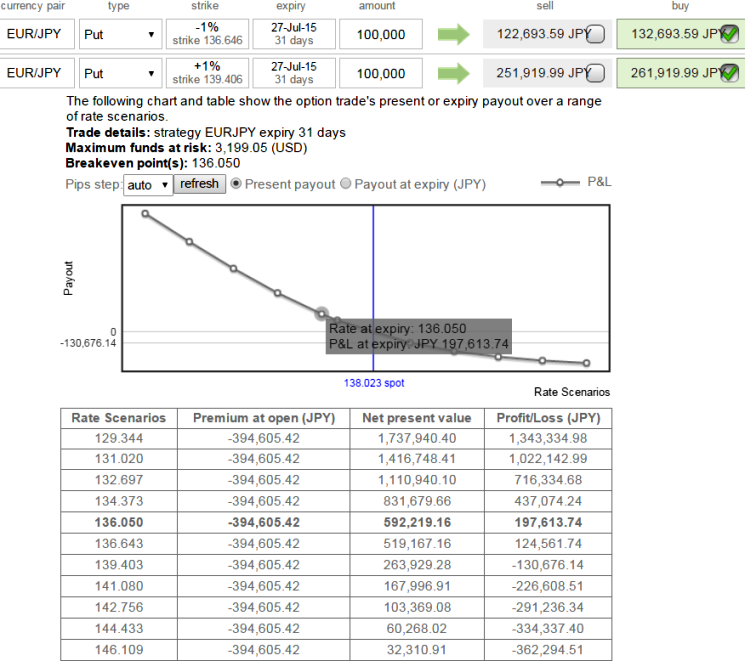

Add long 1M (+1%) In-The-Money -0.61 delta put and simultaneously add one more long 1M (-1%) Out-Of-The-Money -0.37 delta put.

The option combination should have combined delta at -0.99 and slightly negative theta.

This has been the perfect circumstance to deploy the diagonal bear put spread, because we expect EUR/JPY remains unchanged in short run and only goes down below the strike price of the put sold when the long term put expires.

In this scenario, as soon as the near month put expires worthless, the options trader can write another put and repeat this process every month until expiration of the longer term put to reduce the cost of the trade.

FxWirePro: Bear spreads for hedging EUR/JPY slides

Friday, June 26, 2015 6:07 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate