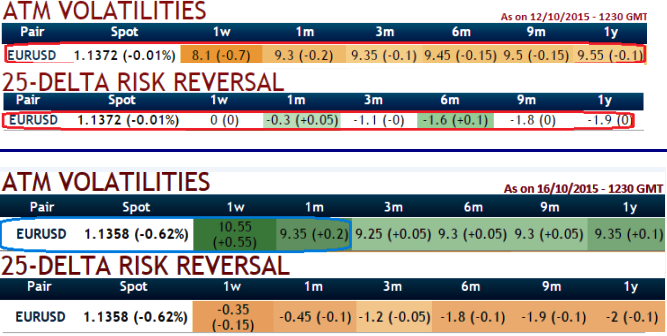

We keep urging often and often with spot FX flashes of EURUSD at 1.1379 delta risk reversal for 1 week contracts have shown bearish signals back again and long term (1M-1Y) put contracts are also on higher demand. Please be informed that comparison between risk reversal from last week to the current situations. EURUSD still maintains the top 3 highest implied volatility of 1W at the money contracts among G7 currency space, almost at 9.6%.

As a reminder, this higher IV represents how much movement today's FX market expects from EURUSD during US sessions and the life span of the option. In that respect, an option buyer is partially buying the market's expectations for this pair.

More importantly, the contracts of this pair for 3m-1y expiries show gradual increase in negative sentiments. So, from this computation what we could read is that EUR may gain until Fed's rate decision and thereafter we could foresee dollar's appreciation as quite certain event. Compare the delta risk reversal of last week with current risk reversals reveals negative sentiments, as a result hedging activities using ATM puts are increasing which in turn led to the overpriced premiums.

Contemplating these factors and synthesizing while projecting the trend we understood the following fact.

In foreign exchange (FX) market prices move to extremes more frequently and these extreme levels is referred to as "Fat Tails".

If more price actions occur at the fat tails, the option trader will mark volatility higher for out-of-money (OTM) and in-the-money (ITM) options then at-the-money (ATM) options and so does happen with EURUSD pair currently.

If there is no downside bias in market expectations of the underlying price then the price of volatility is symmetrical around ATM options.

FxWirePro: Bearish sentiments mounting on EUR/USD – buy risk reversals

Monday, October 19, 2015 9:48 AM UTC

Editor's Picks

- Market Data

Most Popular

3