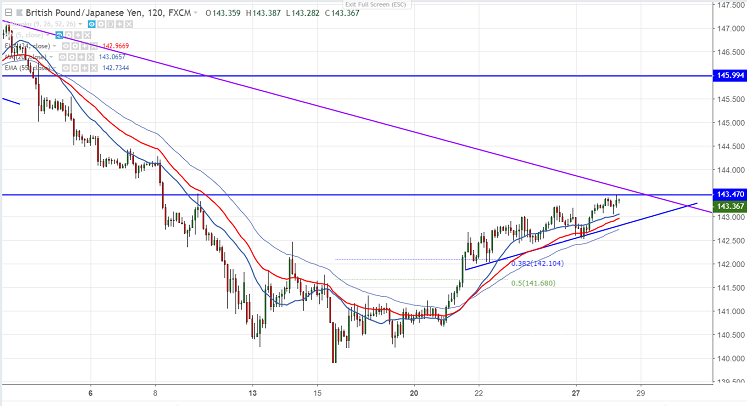

Major resistance- 143.62 (trend line resistance)

GBPJPY is continuing its bullishness for past ten trading days. The pair jumped more than 300 pips from the low of 139.90.

The pair’s major resistance is around 143.50-60 and any convincing break above targets 144.25/144.50.

Òn the lowerside, near term support is around 142.70 (55-2H EMA) and any break below will drag the pair to next level till 142.25 (200- 2H MA)/142.

It is good to buy on dips around 142.85-90 with SL around 142.25 for the TP of 144.25/145.