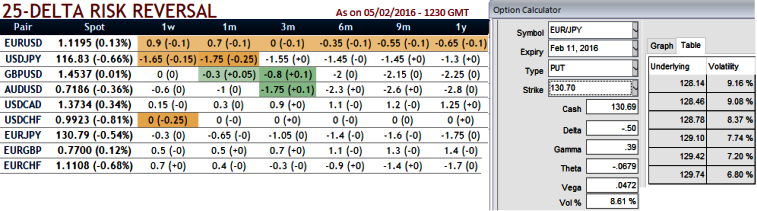

The balanced gush in OTC market sentiments reveal hedging arrangements for downward risks.

The negative delta risk reversal would mean the FX OTC position floods towards downside risk, as a result, puts are relatively costlier than calls as bearish momentum intensified in a long run.

While IVs are creeping in snail's pace in a steady way (1M-8.61%), and it has remained above 9 in a long run but gradually increasing from 3m-1y expiries that would mean that EUR/JPY's downtrend is intact in long run. But OTC volume index has not shown convergence with this indication.

Our recent observation on the IV factor of ATM contracts with 1w expiry of Yen denominated currency crosses tops the list and same is the case with risk reversal table for highest hedging activities eyeing downside risks.

Until there is real domestically-generated inflation, it is hard to call EUR sustainably higher. Headline inflation has been dragged down by energy prices but even core inflation is soft (particularly in Spain/other periphery countries). Services inflation appears to have troughed but is yet to trend higher (services are 43.5% of consumption basket and depend more on domestic factors/wage pressures). Eventually, EURJPY is forecasted for southward targets at 126.50 by Q1 end.

Although we may see a little spike in prices in next week or so, as the hedging activities of downside risks are mounting up, and volatility smiles most frequently tells that traders are willing to pay higher implied volatility prices as the ATM strike price of put grows aggressively in the money.

We had advocated a "put ratio back spreads" a week ago in which ITM shorts were recommended by now those shorts must have certainly derived a handsome gains in the form of receipt of premiums, for now the recommendation is to use reducing vols to stay calm with existing longs, if possible load up with an extra-long on ATM put with 1M expiry in the strategy.

One can only enjoy the difference in the premiums but be mindful of the fact that the paid premium would not be reimbursed if the option is not exercised during the period covered by the transaction.

The opportunity to profit from exchange rate fluctuations applies only up to a certain limit as agreed at the time of entering into the transaction.

For now, with the current spot FX is trading at 130.682, fresh short build up positions should be avoided, while stay calm with longs in 2 lots of 1M ATM -0.49 delta put should be maintained as a means of hedging instruments.

In case of early termination of the transaction, the customer may incur expenses or earn income, the size of which depends on forex market situation then prevailing.

FxWirePro: Buy risk reversals and stay calm with EUR/JPY PRBS for hedging downside risks

Monday, February 8, 2016 8:52 AM UTC

Editor's Picks

- Market Data

Most Popular