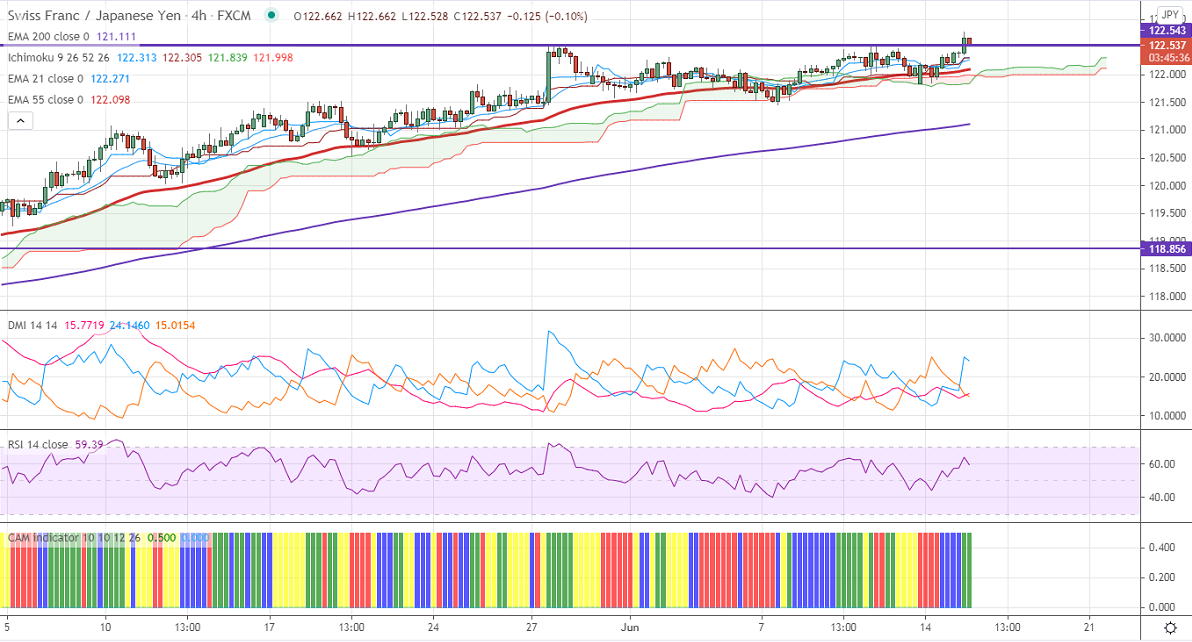

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 122.305

Kijun-Sen- 122.305

CHF/JPY has broken significant resistance 122.55 after a long consolidation. The pair surged to 121.72 and is currently trading around 121.55. The major consolidation in USDCHF is preventing the pair from upside. USDCHF is trading in a narrow range between 0.9055 and 0.89262 for the past three weeks. Any breach below 0.8920 confirms further weakness. USDJPY is holding above 110 level, a major trend continuation only if it breaks 110.35. The intraday trend of CHFJPY is bullish as long as support 121.45 holds.

Intraday analysis-

Trend – Bullish

The pair is holding well above 4-hour Tenken-Sen, Kijun-Sen, and cloud. On the lower side, near-term support is around 121.90. Any violation below will drag the pair down to 121.45/120.50/120 likely. The immediate resistance is only 122.80. Any violation above that level will take the pair to next level to 123.20/123.93/124.45.

Indicator (4-hour chart)

CAM indicator –bullish

Directional movement index – Bearish

It is good to buy on dip around 122.30-35 with SL around 121.45 for a TP of 125.