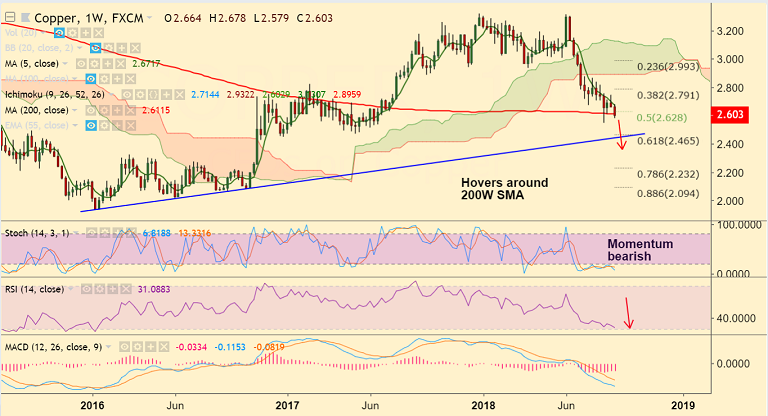

COPPER chart on Trading View used for analysis

- Copper is trading in a narrow range on the day, with the days high at 2.614 and low at 2.591.

- Price action snapped 5-day loosing streak as dollar rally paused.

- However, persistent fears over escalating trade tensions between the United States and top metals consumer China will keep upside limited.

- Copper finds stiff support at 200W SMA at 2.611, break below will see further weakness.

- Technical studies on weekly charts are highly bearish. Momentum with the bears.

- Break below 200W SMA will likely see downside till next major support at 2.465 (converged trendline and 61.8% Fib).

- On the flip side, rejection at 200W SMA will see bounce upto 21-EMA at 2.683. Further upside only on decisive break above.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 68.6128 (Neutral) at 1325 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.