WTI crude oil pared most of its gains on easing geo-political tension. It hit a high of $82.98 at the time of writing and is currently trading at $81.95.

The United States of America has imposed new sanctions on Iran after an attack on Israel. US President Biden said “And our allies and partners have or will issue additional sanctions and measures to restrict Iran’s destabilizing military programs.”

Major factors for crude oil price movement-

US dollar index (Bullish)- negative for Crude. Major resistance - 106.50/107.20. Major support- 105/103.80.

Geopolitical tension- Easing of tension between Israel and Iran (Negative for crude)

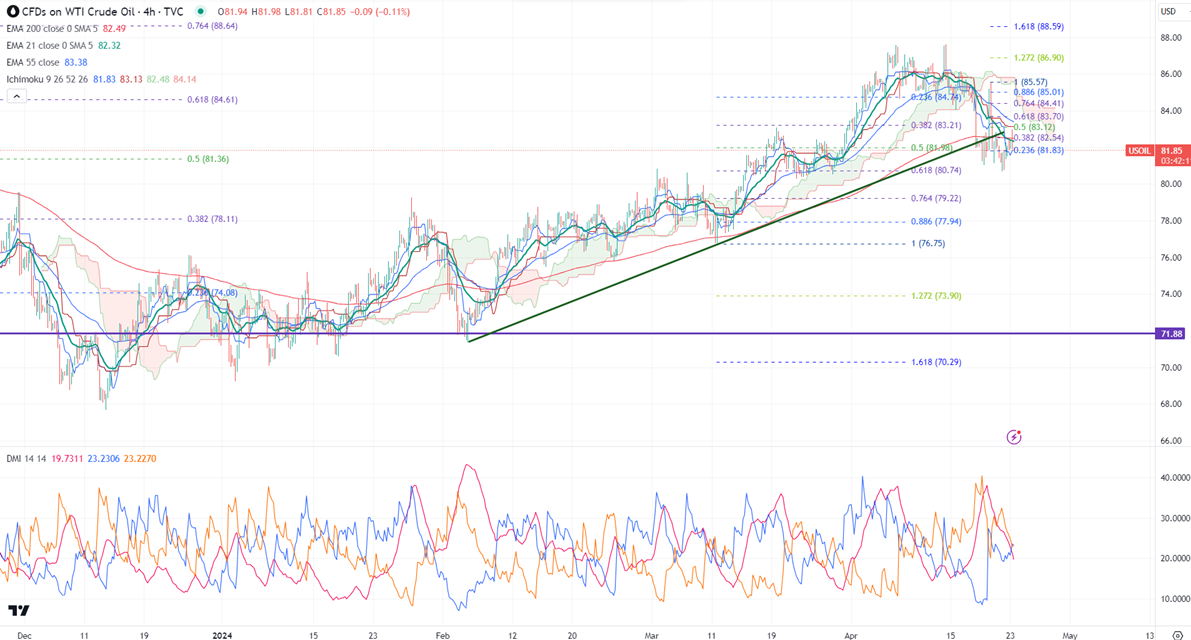

Ichimoku analysis (4- hour chart)

Tenken-Sen- $81.83

Kijun-Sen- $83.13

The immediate resistance is around $83. Any jump above target $83.60/$84/$85. On the lower side, near-term support is around $80. Any breach below will drag the commodity down to $78/$76.

It is good to buy on dips around $80 with SL around $78 for a TP of $85.