Crude oil-

WTI crude oil showed a minor sell-off on the strong US dollar. It hit a low of $80.51 yesterday and is currently trading at $81.04.

U.S. crude inventories increased by about 9.3 million barrels for the week ended Mar. 22, compared with a forecast of a decrease of about 1.2M barrels, according to API.

Major factors for crude oil price movement-

US dollar index (Bullish)- negative for Crude. Major resistance - 104.25/105. Major support- 103/102.40.

Geopolitical tension- Escalation of tension between Ukraine and Russia (positive for crude)

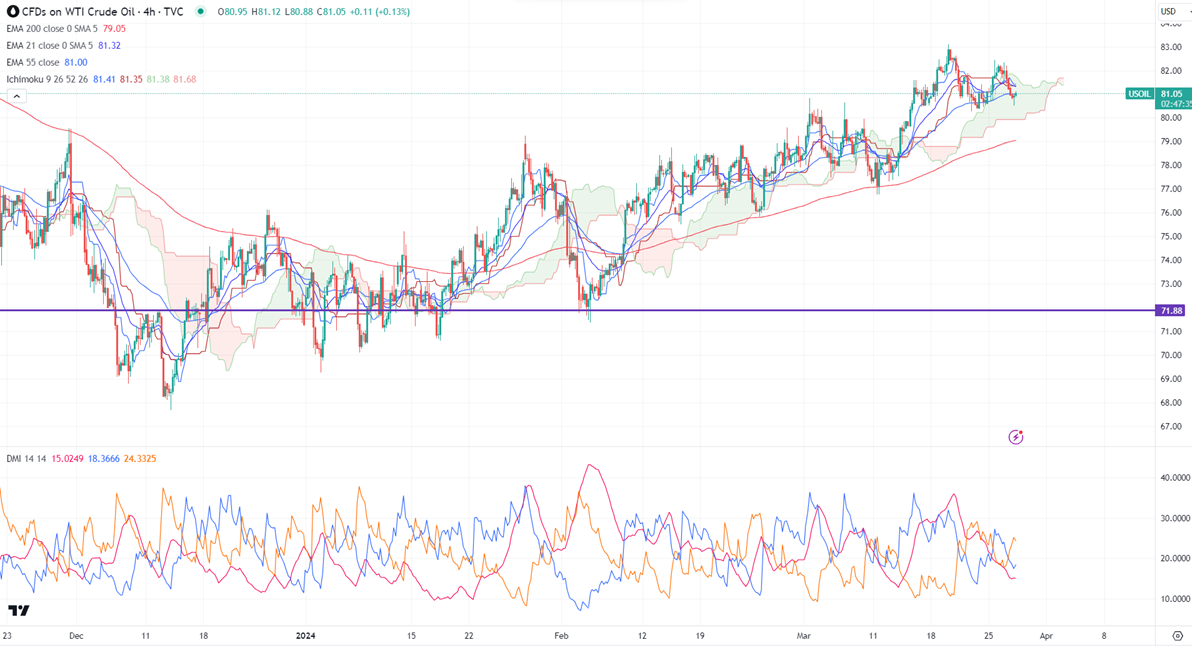

Ichimoku analysis (4- hour chart)

Tenken-Sen- $81.41

Kijun-Sen- $81.35

The immediate resistance is around $82.55. Any jump above target $83.10/$84. On the lower side, near-term support is around $81.50. Any breach below will drag the commodity down to $80.80/$80.45/$80/$79.

It is good to buy on dips around $79.50 with SL around $77.90 for a TP of $83.50.