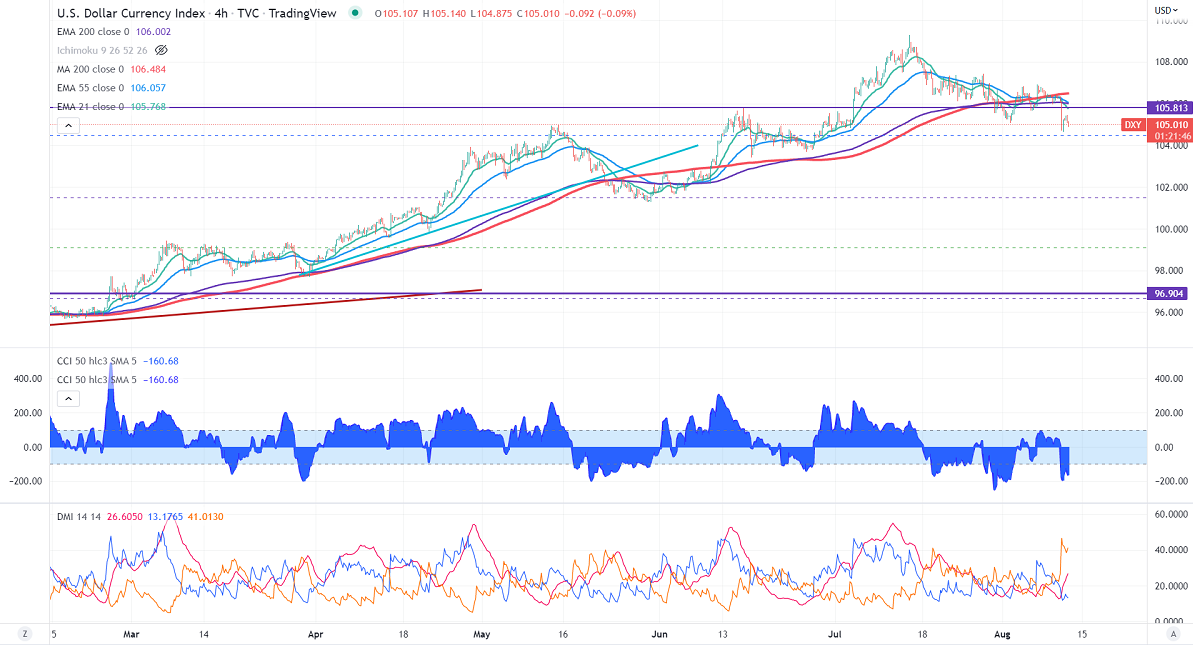

Major support- 104.40

Major resistance- 106

DXY pared most of its after dismal US CPI data. The inflation slowed from 9.1% YOY to 8.5% YoY, below expectations of 8.7%. This has reduced the chance of aggressive rate hikes by the Fed. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep dropped to 42.5% from 68% a day ago. Markets eye US PPI data for further direction.

On the lower side, near-term support is around 104.45 (23.6% fib) and violation below will drag the index down to 103.40/103. Significant resistance is around 105.50, and breach above targets 106/107. Overall bullish continuation only above 109.35.

It is good to sell on rallies around 105.25-30 with SL around 106 for TP of 103.