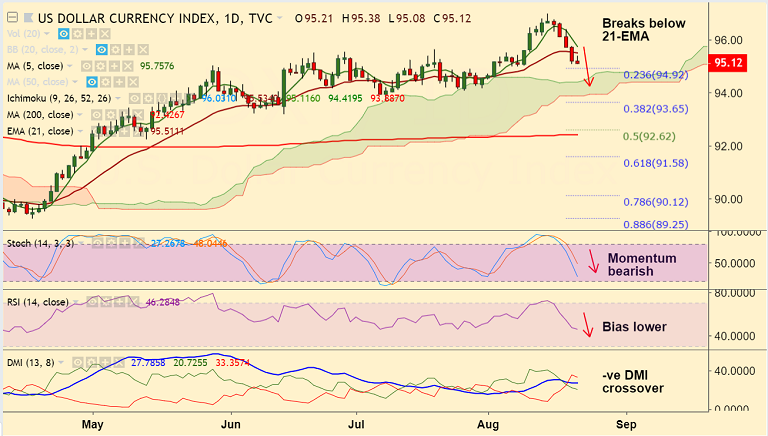

- The dollar index is extending downward streak for the 5th straight session.

- Recovery attempts were rejected at session high at 95.38, bias is bearish.

- Price has close below 21-EMA on Tuesday's trade raising scope for further weakness.

- Technical indicators are biased bearish. RSI and Stochs are sharply lower.

- We see -ve DMI crossover on +ve DMI and MACD is on verge of a bearish crossover on signal line.

- Next bear target lies at 50-DMA at 94.99 ahead of 38.2% Fib at 93.65. Retrace above 21-EMA could see minor upside.

Support levels - 94.99 (50-DMA), 94, 93.65 (38.2% Fib)

Resistance levels - 95.50 (21-EMA), 95.75 (5-DMA), 96

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -81.1822 (Neutral) at 1110 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.