Before we proceed further, please go through below weblink where we’ve stated the potential bearish pressure as a result of head and shoulder candlestick charting pattern which is bearish in nature.

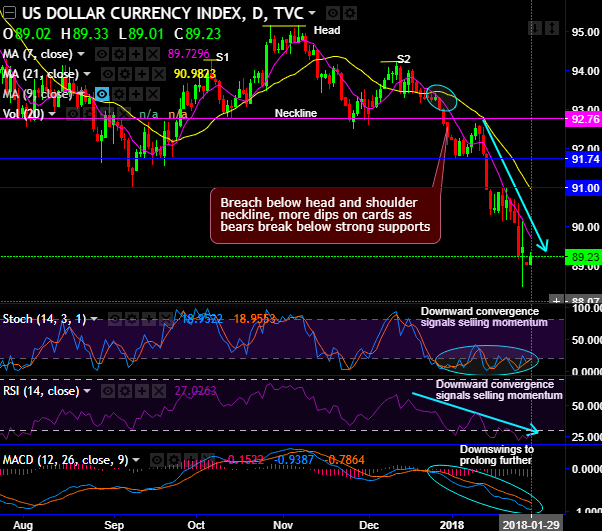

Well, please glance at daily plotting of the DXY chart, we trace out mounting bearish pressures ever since the bears have managed to break below the neckline of head and shoulder pattern.

Both leading (RSI and stochastic curves) & lagging (MACD and DMAs) indicators are substantiating this bearish stance. Subsequently, the bears are now on the verge of extending 3-years lows.

Although the dollar index slightly spiked today (DXY at 89.11), however, the current prices have remained well below 7 & 21 DMAs, its slide on Friday to counter Thursday’s rally was major owing to the commentaries from Donald Trump.

The DXY remains centered around the 89.00 area with gravity still expected to remain a threat to the index. Note however that potential trade tensions may also continue to lurk near the surface, with US President Trump highlighting “very unfair” EU trade policies over the weekend. With skepticism towards the dollar still significant at this juncture, investors may continue to disregard underlying dollar support stemming from rate differentials.

Coupled with palpable anxiety around the longevity of the unusually swift dollar downtrend, while contemplating above driving forces, we have already advocated the vol structure is motivating considerations of short front vs long back USD put calendar spreads as theta harvesting overlays on dollar shorts.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -11 (which is neutral) while articulating at 10:22 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025