EUR/CAD chart on Trading View used for analysis

FxWirePro Currency Strength Index for EUR/CAD: Bias Bearish

FxWirePro's Hourly EUR Spot Index was at 113.327 (Bullish)

FxWirePro's Hourly CAD Spot Index was at -140.73 (Bearish)

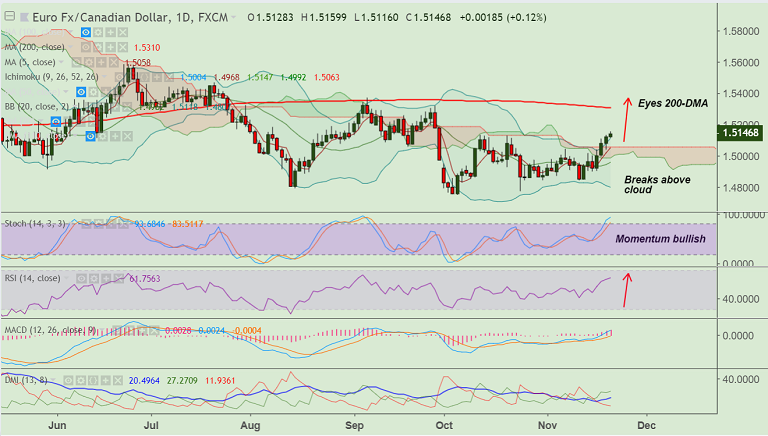

Technical Analysis: Bias Bullish

- Breaks above daily cloud

- Momentum studies are bullish

- RSI above 60, bias higher

- Volatility rising, Bollinger Bands are widening

Support levels - 1.51 (110-EMA), 1.5057 (5-DMA), 1.5004 (20-DMA), 1.4847 (Nov 12 low)

Resistance levels - 1.52, 1.5310 (200-DMA)

Recommendation: Good to go long on dips around 1.5140, SL: 1.5050, TP: 1.52/ 1.53

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: EUR/CAD Trade Idea

Wednesday, November 21, 2018 12:42 PM UTC

Editor's Picks

- Market Data

Most Popular

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One