Inflation race: The long-term path for EUR/CHF will be determined by who sees inflation first: Switzerland or the Euro area. Our guess would be the Euro area (though neither looks likely to see strong inflation any time soon). The SNB's inflation forecasts extend out to Q3 2018, but extrapolating the last year of forecasts, it would take until Q3 2019 to reach the 2% target.

The 1.2% conditional inflation forecast for Q3 2018 also assumes rates stay at -0.75% throughout the forecast period. That weak inflation outlook should allow the SNB to keep its nominal rates lowest in the world. While its real rates are amongst the highest in G10, we have shown before that nominal rates are more important in driving spot FX returns.

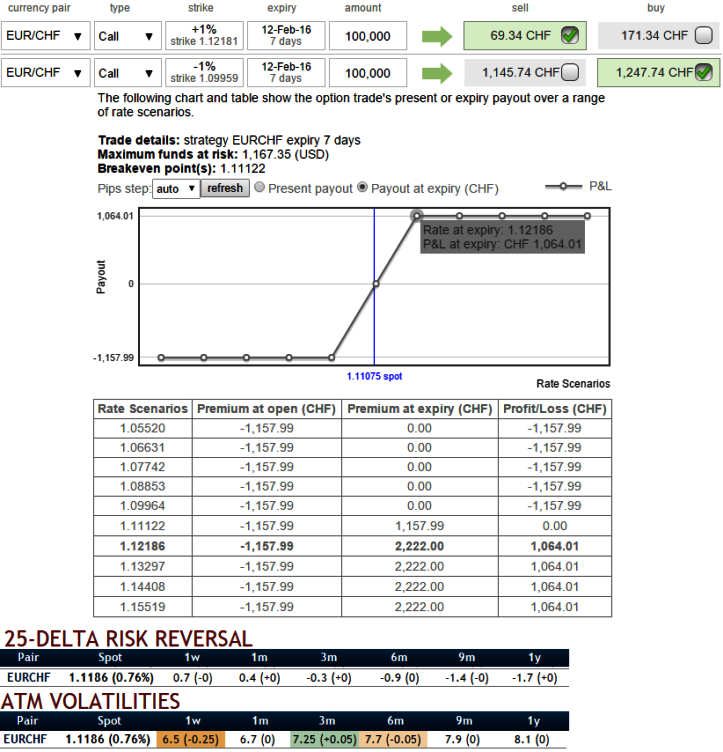

While, in OTC markets sentiments nothing much has changed, referring to our previous posts the least implied volatilities and slightly positive delta risk reversals for EURCHF for 1w-1m expiries has kept us sideways or mildly bullish.

Comparing this sluggish implied volatilities underlying spot price movements, while conducting technical analysis we found narrow range trend for this pair but slightly bullish biased in short run.

During such lower IVs and non-directional scenarios, with spot FX at 1.1102 a speculator in foreign trade can again eye on short strangle raising upper strikes at 1.1275 levels, so short both puts and calls at the same spot FX levels with identical strikes and expiries. Precisely, the recommendation is short (1.5%) out of the money calls and (1.5%) out of the money puts with similar maturities or net credit.

This is meant to be a method of certain profits as we anticipate the spot FX to remain stable well within the strikes and expiries what has been chosen. But a seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

As per the risk reversals, even if it spikes up it would not be dramatic movements, so this is instinctive owing to the higher probability of the market 'swinging' in range bounded trend.

In contrast, a gradual move higher in the pair would not be surprised, so on the hedging grounds, buy 2W (1%) in the money 0.50 delta call option while shorting 1W (1%) out of the money call option with positive theta and delta closer to zero for net debit.

Why call spread: An investor with a bullish mindset often deploys this strategy and wants to capitalize on a modest advance in price of the EURCHF. If the investor's opinion is very bullish on this pair, it will generally prove more profitable to make a simple call purchase.

Risk Reward profile: An investor will also turn to this spread when there is discomfort with either the cost of purchasing and holding the long call alone, or with the conviction of his bullish market opinion. Maximum loss for this spread will generally occur as EURCHF declines below the lower strike price. If both options expire out-of-the-money with no value, the entire net debit paid for the spread will be lost.

FxWirePro: EUR/CHF still offers speculating opportunity in writing strangles but debit call spreads for hedgers

Friday, February 5, 2016 12:18 PM UTC

Editor's Picks

- Market Data

Most Popular