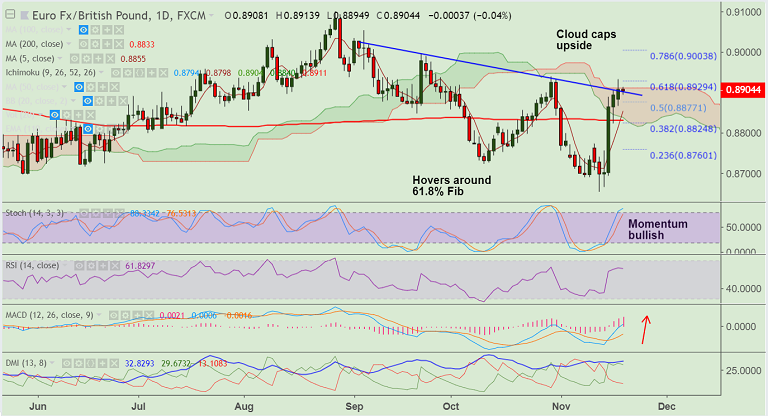

EUR/GBP chart on Trading View used for analysis

FxWirePro Currency Strength Index for EUR/GBP: Bias Bullish

FxWirePro's Hourly EUR Spot Index was at 90.561 (Bullish)

FxWirePro's Hourly GBP Spot Index was at -95.3393 (Bearish)

Technical Analysis: Bias Bullish

- EUR/GBP has shown a break above strong trendline resistance at 0.89

- The pair struggles at daily cloud, break above to see further upside

- RSI is above 50 and MACD is showing a bullish crossover on signal line.

- We evidence a bullish divergence on RSI and Stochs which raises scope for further gains.

Support levels - 0.8877 (50% Fib), 0.8856 (5-DMA), 0.8833 (200-DMA)

Resistance levels - 0.8929 (61.8% Fib), 0.8939 (Oct 30 high), 0.90 (78.6% Fib)

Recommendation: Stay long on break above daily cloud, SL: 0.8870, TP: 0.8930/ 0.90

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: EUR/GBP Trade Idea

Tuesday, November 20, 2018 6:42 AM UTC

Editor's Picks

- Market Data

Most Popular

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts