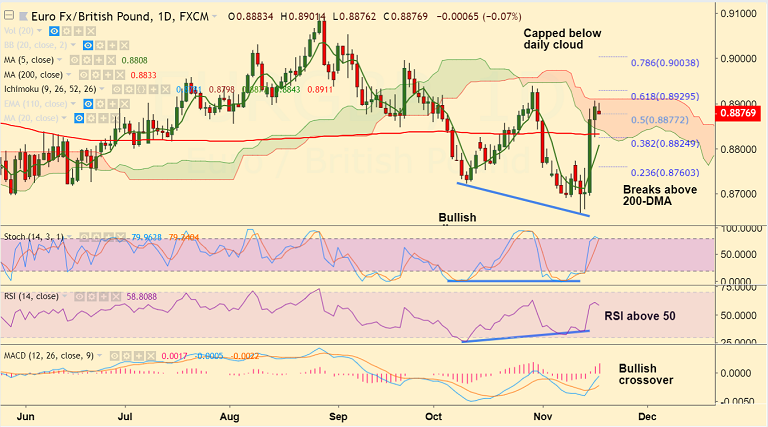

EUR/GBP chart on Trading View used for analysis

- EUR/GBP struggles at daily cloud top resistance, break above to see further upside.

- The pair has been rejected at session highs, trades 0.13% lower on the day at 0.8882 at the time of writing.

- Momentum studies are bullish. RSI is above 50 and MACD is showing a bullish crossover on signal line.

- We also evidence a bullish divergence on RSI and Stochs which raises scope for further gains.

- Break above cloud targets 61.8% Fib at 0.8929 ahead of 0.8939 (Oct 30 high) and 0.90 (78.6% Fib).

- On the flip side, retrace below 200-DMA negates bullish bias.

Support levels - 0.8877 (50% Fib), 0.8833 (200-DMA), 0.8808 (5-DMA)

Resistance levels - 0.8929 (61.8% Fib), 0.8939 (Oct 30 high) and 0.90 (78.6% Fib)

Recommendation: Stay long on break above daily cloud, SL: 0.8870, TP: 0.8930/ 0.90

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures