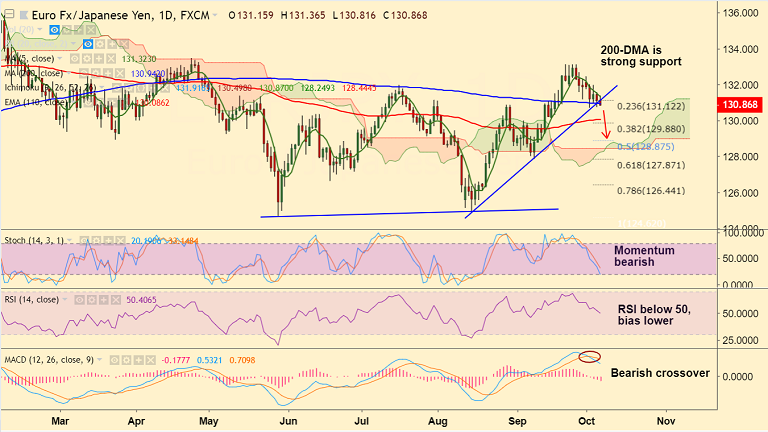

EUR/JPY chart on Trading View used for analysis

- EUR/JPY trades 0.22% lower on the day at 130.87 at the time of writing.

- The major is on track to close in the red for the 2nd straight week.

- The single currency is being hit on European political concerns.

- Price is extending weakness after spinning top formation on the previous week's chart.

- 200-DMA at 130.94 is strong support for the pair ahead of 5W-SMA at 130.69.

- Momentum studies are bearish. Stochs and RSI are sharply lower and MACD is showing a bearish crossover on signal line.

- Decisive break below 200-DMA will see extension of weakness. Scope for dip till 110-EMA at 130.08.

- Bounce off at 200-DMA negates bearish bias. The pair could then retest 131 levels.

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -32.9275 (Neutral), while Hourly JPY Spot Index was at 27.0931 (Neutral) at 0945 GMT.

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.